Portfolio Optimization using Reverse Quantum Annealing#

Introduction#

This chapter presents the utilization of Reverse Quantum Annealing for resolving portfolio optimization issues through the utilization of OpenJij. Reverse Quantum Annealing is an approach that amalgamates classical optimization methodologies with quantum annealing. The chapter is structured in the following manner: We will elaborate on the methods of resolving portfolio optimization problems through classical algorithms, standard quantum annealing, and reverse quantum annealing. Subsequently, we contrast the outcomes obtained from these techniques. Throughout the chapter, we will describe the implementation of quantum annealing via OpenJij and accentuate any potential limitations or caveats of the numerical experiments.

Note: Note: Execution of this content requires OpenJij version 0.4.9 or higher. If necessary, please execute the following command to update OpenJij prior to proceeding with this notebook.

pip install -U openjij

Portfolio Optimization#

In the realm of asset management, investors strive to achieve substantial returns while minimizing risk as much as feasible. Consequently, a prevalent approach is to construct a diversified investment portfolio by integrating assets with moderate returns but minimal (or no) risk and assets with substantial expected returns but also substantial risk.

In this scenario, an optimal portfolio must be chosen in order to achieve the maximal profit for a given level of risk or to minimize the risk while obtaining the same profit. One of the most widely utilized methodologies currently is the Modern Portfolio Theory proposed by Markowitz. This method takes into account the interdependencies among the stocks comprising the portfolio and aims to minimize their covariance [1].

, and denote the weight of each stock in the portfolio, the covariance among the stocks, the expected return of each stock, and the total return of the portfolio, respectively.

Here, the Sharpe ratio is a widely-utilized metric for assessing the performance of a portfolio.

Portfolio Evaluation and Optimization#

As per the definition of the Sharpe ratio, a high value connotes high returns or low risk (volatility). Among portfolios constructed from a given set of stocks, the combination that attains the highest Sharpe ratio can be considered as the combination that yields the highest returns per a unit of risk. Thus, the problem of portfolio optimization can be rephrased as the problem of maximizing the Sharpe ratio under a given constraint.

In practice, this optimization process involves identifying stocks and determining the proportion of investment allocated to each stock. In other words, it is a combinatorial optimization problem that involves determining the selection of stocks and the weight assigned to each stock. For simplicity, this tutorial will adopt a strategy in which each stock is assigned an equal weight, as per the referenced paper [2]. We select stocks out of a total of stocks and find the combination that maximizes the Sharpe ratio. Then, the problem can be formulated into the QUBO form as follows.

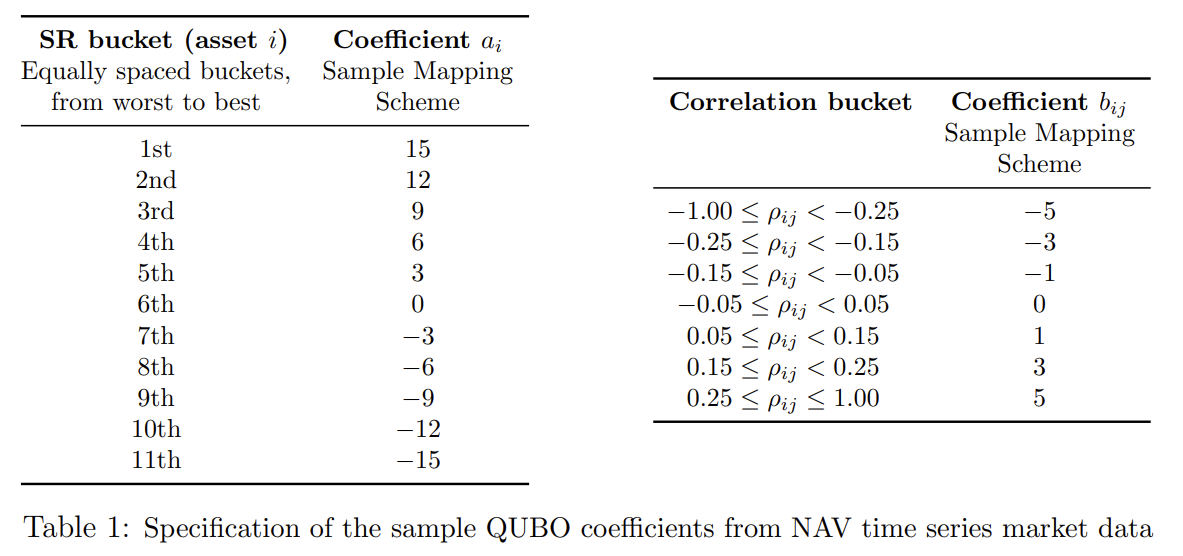

Here, is a binary variable that denotes the selection of each stock, where a value of indicates inclusion in the portfolio and a value of indicates non-inclusion. is the score of attractiveness, derived from the performance of the individual stock, and represents the fines or bonuses as determined by the pairwise correlation between stocks.

The specific values of and are established in accordance with the Table 1 below.

The groups in this table are criteria established by the portfolio’s creators, with stocks ordered by their attractiveness. The table displays the groups formed when they are ranked and divided equally. The attractiveness criterion can also incorporate factors such as a high rate of return, but for this tutorial, we simply use the order of individual stocks based on the Sharpe ratio. is determined by the value of the component of the correlation matrix obtained from the time series of log returns.

By performing quantum annealing using this QUBO, we should be able to obtain the optimal portfolio. If multiple stocks are selected, a constraint on the number of stocks can be added. However, as described in the referenced paper [2], when constraints are added to the QUBO using this method, the large interaction (penalty) introduced can also affect the annealing performance and the final results obtained. In a real-world scenario, the number of stocks in the optimal portfolio is unknown, thus, this tutorial performs the same optimization without any restriction on the number of stocks.

Portfolio Optimization with Reverse Quantum Annealing#

The problem of portfolio optimization in the real world is to select a subset of stocks from a market with a vast array of options. Additionally, due to the huge number of possible stock combinations, it is likely that there exist numerous local minima, which correspond portfolios with Sharpe ratios that are quite close to the maximum. Conventional algorithms, when trapped in the trough of such an energy landscape, need a significant amount of time and resources to escape. To circumvent the above issue and solve portfolio optimization problems more efficiently, computational methods such as quantum annealing, which can handle a large number of correlations and are less prone to getting trapped in local minima, are more effective.

However, as demonstrated in the reference paper [2], when only simple forward annealing is used, the time required to reach the optimal solution increases dramatically as the number of issues increases. This is because the difference in energy between the optimal solution and local minima with a Sharpe ratio close to the optimal solution is small. Due to a high potential barrier between these levels with almost no energy change, transition from local minima to optimal require a longer time. Furthermore, in actual quantum annealing machines, the system may be excited by thermal noise or other factors during standard annealing, resulting in a deviation from the intended time evolution and a final solution that is not truly optimal obtained.

Reverse Quantum Annealing#

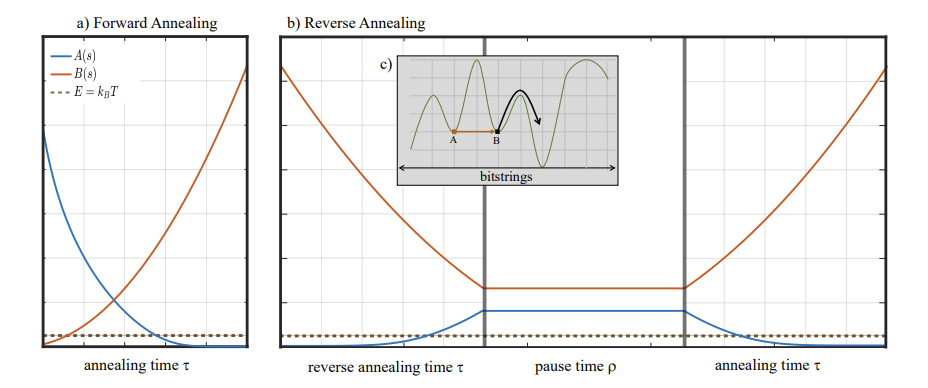

One of the proposed methods for addressing the challenges associated with using quantum annealing in portfolio optimization is reverse quantum annealing. As the name implies, this approach involves conducting quantum annealing in a manner that incorporates a step in the opposite direction of conventional forward annealing. The time-dependent Hamiltonian of standard forward annealing is represented as

where is the magnitude of the transverse magnetic field applied to the system during annealing, and represents the amplitude of the problem Hamiltonian , respectively. As depicted in the following figure a), in the case of forward annealing, is gradually decreased as the annealing progresses, and concurrently, is made dominant. At the completion of annealing, .

In contrast, reverse annealing starts from , as depicted in Figure b). In this method, is initially decreased, in contrast to the standard annealing. This is referred to as the reverse phase. In this phase, the system’s energy is inversely increased, making it easier to tunnel the potential barrier between A and B, as illustrated in c). After and reach a specific value, the system is kept in the same state and allowed to wait for a while. This is referred to as the pause phase. During this phase, a high energy state is maintained, increasing the likelihood of thermal hopping. The potential barrier on the right side of B is also easily overcome. This suggests that the possibility of escaping from the initial local minimum and reaching a near-optimal solution is increased. Finally, the optimal solution is attained by conducting standard annealing in the forward phase, which once again makes smaller and larger. In this protocol, the performance of the final solution may also be impacted by the value at which is stopped in the reverse phase, the duration of each phase, etc.

Portfolio Optimization Procedure with Reverse Quantum Annealing#

From the previous discussion, reverse annealing requires a reverse phase initial state. While it can be used randomly generated initial states, it is predicted that the efficacy of the optimal solution search will be enhanced when a specific local minumu state is implemented. The reference paper [2] employs the output generated by a conventional algorithm. This tutorial will follow the method outlined in the reference paper [2], which entails the following steps.

Generation of data for stocks to be optimizaed

Implementation of a classical algorithm and examination of its results

Search for an optimal solution through standard forward annealing

Search for an optimal solution through reverse quantum annealing

Exploration of parameters for reverse quantum annealing

Generation of stock data and implementation of classical algorithms#

Generation of stock data to be optimized#

We generate a chart of stocks by Brownian motion using the given initial values according to the method in reference paper [2].

import numpy as np

import matplotlib.pyplot as plt

import random

#Magic numbers to generate assets

rho = 0.1 # input uniform correlation

mu = 0.075 # expected value

sigma = 0.15 # volatility/standard error

r0 = 0.015 # no risk return

---------------------------------------------------------------------------

ModuleNotFoundError Traceback (most recent call last)

Cell In[1], line 2

1 import numpy as np

----> 2 import matplotlib.pyplot as plt

3 import random

5 #Magic numbers to generate assets

ModuleNotFoundError: No module named 'matplotlib'

The motion of the chart at each time, as outlined in Appendix A of reference paper [2], is derived from the motion at the preceding time, as follows:

where is the multivariate normal distribution following the uniform correlation matrix ρ, constructed via the Cholesky decomposition.

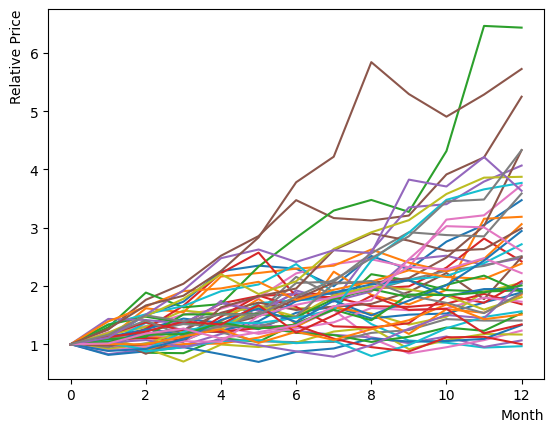

We shall now implement and run this equation, and plot the chart to observe its appearance. By beginning with the same initial value and examining the 12-month trend, we can discern the overall behavior to spread out. Additionally, we can observe certain stocks note any significant increases or decreases.

# generate correlated normal probability variables, Zn

def createZvariables(N, rho):

rho_mat = np.full((N,N), rho)

rho_mat[range(N), range(N)] = 1.0

rho_chole = np.linalg.cholesky(rho_mat)

zNs_temp = np.random.normal(0, 1, (10000, N))

zNs = zNs_temp @ rho_chole

return zNs

# generate Brownian motion of the chart

def GetNextSt(St, mu, sigma, zN):

Deltat = 1

scale = np.exp((mu-0.5*sigma*sigma)*Deltat + sigma*zN*np.sqrt(Deltat))

NextSt = St * scale

return NextSt

Nassets = 48 # the number of stocks

chart = list()

ZList = list()

Zvariables = createZvariables(Nassets, rho)

Zlabels = random.sample([x for x in range(10000)], 12) #Z variable shuffle

for label in Zlabels:

ZList.append(Zvariables[label])

for iasset in range(Nassets):

chart_asset = [1.0] # initial value: 1.0 at relative price

# simulate 12 steps (12 months)

for month in range(12):

chart_asset.append(GetNextSt(chart_asset[month], mu, sigma, ZList[month][iasset]))

chart.append(chart_asset)

#print(chart_asset) # display specific values for each stocks

plt.plot(list(range(13)), chart_asset)

plt.xlabel("Month", loc="right")

plt.ylabel("Relative Price", loc="top")

plt.show()

Next, the Sharpe Ratio is calculated for each stock. Utilizing the realized Sharpe Ratio, we evaluate the earlier outcome. Following its definition, we determine the average return exceeded the risk-free rate of return, and the standard deviation of the excess return rate . As plot of the chart , when the number of stocks is limited, there is a significant bias due to chance and existence of correlation among the stocks in generation condition. Therefore, we mitigate their impact by generating 100 iterations and assessing the average Shape ratio. Consequently, we can see that the average Sharpe ratio of the stocks is . Additionally, when the definition of the Sharpe ratio calculation is changed, the Sharpe ratio will naturally vary, but it will generally remain within the range of .

# function for generating assets

def CreateAssets(Nassets):

chart = list()

ZList = list()

Zvariables = createZvariables(Nassets, rho)

Zlabels = random.sample([x for x in range(10000)], 12)

for label in Zlabels:

ZList.append(Zvariables[label])

for iasset in range(Nassets):

chart_asset = [1.0]

for month in range(12):

chart_asset.append(GetNextSt(chart_asset[month], mu, sigma, ZList[month][iasset]))

chart.append(chart_asset)

return chart

# function for computing standard Sharpe ratio

def CalculateSharpeRatio(asset):

monthly_return = list()

for month in range(12):

valueChange = asset[month+1]/asset[month] - 1.0 - r0

monthly_return.append(valueChange)

annualized_excess_return = np.mean(monthly_return)

volatility = np.std(monthly_return, ddof=1)

return(annualized_excess_return/volatility)

# function for computing Sharpe ratio based on log-return

def CalculateSharpeRatio_log(asset):

monthly_log_return = list()

for month in range(12):

valueChange = np.log(asset[month+1]/asset[month])

monthly_log_return.append(valueChange)

mean_log_return = np.mean(monthly_log_return)

volatility = np.std(monthly_log_return, ddof=1)

return (mean_log_return-r0)/volatility

# function for computing Sharpe ratio with a slightly different definition

def CalculateSharpeRatio_2(asset):

monthly_log_return = list()

monthly_return = list()

for month in range(11):

log_valueChange = np.log(asset[month+1]/asset[month])

monthly_log_return.append(log_valueChange)

valueChange = asset[month+1]/asset[month] - 1.0

monthly_return.append(valueChange)

annualized_excess_return = np.mean(monthly_return) - r0

volatility = np.std(monthly_log_return, ddof=1)

return (annualized_excess_return/volatility)

allmean = 0

for ntry in range(100): # multiple execution to eliminate the effect of correlations that are not in the same set

Chart = CreateAssets(48) # create a specified number of assets

mean_SR = 0.0

n = 0.

for asset in Chart:

assetSR = CalculateSharpeRatio(asset) # choose the way of computation of Sharpe ratio

#assetSR = CalculateSharpeRatio_log(asset)

#assetSR = CalculateSharpeRatio_2(asset)

mean_SR = ((mean_SR*n)+assetSR) / (n+1) # average of Shape ratio

n+=1

print("SubSet "+ str(ntry)+ " average Sharpe Ratio: " + str(mean_SR))

allmean = ((allmean*ntry)+mean_SR) / (ntry+1)

print("Average Sharpe Ratio of all generated: "+ str(allmean))

SubSet 0 average Sharpe Ratio: 0.3837906264586552

Average Sharpe Ratio of all generated: 0.3837906264586552

SubSet 1 average Sharpe Ratio: 0.28337786315793195

Average Sharpe Ratio of all generated: 0.3335842448082936

SubSet 2 average Sharpe Ratio: 0.27848598101975913

Average Sharpe Ratio of all generated: 0.31521815687878213

SubSet 3 average Sharpe Ratio: 0.374543783028112

Average Sharpe Ratio of all generated: 0.3300495634161146

SubSet 4 average Sharpe Ratio: 0.5717125711998081

Average Sharpe Ratio of all generated: 0.37838216497285326

SubSet 5 average Sharpe Ratio: 0.283219918751404

Average Sharpe Ratio of all generated: 0.36252179060261175

SubSet 6 average Sharpe Ratio: 0.46652989369562214

Average Sharpe Ratio of all generated: 0.37738009104447034

SubSet 7 average Sharpe Ratio: 0.4514577533529913

Average Sharpe Ratio of all generated: 0.38663979883303545

SubSet 8 average Sharpe Ratio: 0.18780237065172986

Average Sharpe Ratio of all generated: 0.3645467512573348

SubSet 9 average Sharpe Ratio: 0.4376817861761366

Average Sharpe Ratio of all generated: 0.371860254749215

SubSet 10 average Sharpe Ratio: 0.2864499313298963

Average Sharpe Ratio of all generated: 0.3640956798929133

SubSet 11 average Sharpe Ratio: 0.4473544635772649

Average Sharpe Ratio of all generated: 0.3710339118666093

SubSet 12 average Sharpe Ratio: 0.33794006342623756

Average Sharpe Ratio of all generated: 0.3684882312173499

SubSet 13 average Sharpe Ratio: 0.494046978181512

Average Sharpe Ratio of all generated: 0.37745671314336143

SubSet 14 average Sharpe Ratio: 0.5478917540762928

Average Sharpe Ratio of all generated: 0.3888190492055569

SubSet 15 average Sharpe Ratio: 0.4727096558748867

Average Sharpe Ratio of all generated: 0.39406221212239

SubSet 16 average Sharpe Ratio: 0.41998204748920837

Average Sharpe Ratio of all generated: 0.39558690832043814

SubSet 17 average Sharpe Ratio: 0.33066338717184823

Average Sharpe Ratio of all generated: 0.39198004603440534

SubSet 18 average Sharpe Ratio: 0.44297415887450636

Average Sharpe Ratio of all generated: 0.3946639467102001

SubSet 19 average Sharpe Ratio: 0.48142545808164855

Average Sharpe Ratio of all generated: 0.3990020222787726

SubSet 20 average Sharpe Ratio: 0.44547458948872704

Average Sharpe Ratio of all generated: 0.4012150016697228

SubSet 21 average Sharpe Ratio: 0.6674429161967423

Average Sharpe Ratio of all generated: 0.41331627051186004

SubSet 22 average Sharpe Ratio: 0.5653388170821128

Average Sharpe Ratio of all generated: 0.4199259464496971

SubSet 23 average Sharpe Ratio: 0.46874456573691264

Average Sharpe Ratio of all generated: 0.42196005558666444

SubSet 24 average Sharpe Ratio: 0.5153540143088683

Average Sharpe Ratio of all generated: 0.4256958139355526

SubSet 25 average Sharpe Ratio: 0.4601719230807883

Average Sharpe Ratio of all generated: 0.42702181813344625

SubSet 26 average Sharpe Ratio: 0.4162585497593574

Average Sharpe Ratio of all generated: 0.42662317856403553

SubSet 27 average Sharpe Ratio: 0.3252729369224568

Average Sharpe Ratio of all generated: 0.4230035270768363

SubSet 28 average Sharpe Ratio: 0.30070437675349765

Average Sharpe Ratio of all generated: 0.41878631499672114

SubSet 29 average Sharpe Ratio: 0.5441639109919798

Average Sharpe Ratio of all generated: 0.4229655681965631

SubSet 30 average Sharpe Ratio: 0.4693717636668237

Average Sharpe Ratio of all generated: 0.4244625422439908

SubSet 31 average Sharpe Ratio: 0.4051177822606303

Average Sharpe Ratio of all generated: 0.4238580184945108

SubSet 32 average Sharpe Ratio: 0.47089043167137207

Average Sharpe Ratio of all generated: 0.4252832431362339

SubSet 33 average Sharpe Ratio: 0.3537211353255551

Average Sharpe Ratio of all generated: 0.4231784752594492

SubSet 34 average Sharpe Ratio: 0.39885911862875273

Average Sharpe Ratio of all generated: 0.4224836364985722

SubSet 35 average Sharpe Ratio: 0.3907199794270468

Average Sharpe Ratio of all generated: 0.4216013126910298

SubSet 36 average Sharpe Ratio: 0.29880957926648966

Average Sharpe Ratio of all generated: 0.41828261719306925

SubSet 37 average Sharpe Ratio: 0.35924331280081473

Average Sharpe Ratio of all generated: 0.4167289512880099

SubSet 38 average Sharpe Ratio: 0.3785175688544557

Average Sharpe Ratio of all generated: 0.4157491722512521

SubSet 39 average Sharpe Ratio: 0.3410829237532271

Average Sharpe Ratio of all generated: 0.41388251603880144

SubSet 40 average Sharpe Ratio: 0.3412379619110964

Average Sharpe Ratio of all generated: 0.41211069764544284

SubSet 41 average Sharpe Ratio: 0.37596173215174317

Average Sharpe Ratio of all generated: 0.41125000799083095

SubSet 42 average Sharpe Ratio: 0.37550594801023696

Average Sharpe Ratio of all generated: 0.4104187507819799

SubSet 43 average Sharpe Ratio: 0.370701017353332

Average Sharpe Ratio of all generated: 0.40951607502223797

SubSet 44 average Sharpe Ratio: 0.5422038575483876

Average Sharpe Ratio of all generated: 0.4124646924117079

SubSet 45 average Sharpe Ratio: 0.46108825968677425

Average Sharpe Ratio of all generated: 0.413521726482905

SubSet 46 average Sharpe Ratio: 0.38076948950092876

Average Sharpe Ratio of all generated: 0.4128248703769055

SubSet 47 average Sharpe Ratio: 0.34627640689318245

Average Sharpe Ratio of all generated: 0.41143844405432795

SubSet 48 average Sharpe Ratio: 0.3952960697555263

Average Sharpe Ratio of all generated: 0.41110900784414833

SubSet 49 average Sharpe Ratio: 0.28506773270728536

Average Sharpe Ratio of all generated: 0.4085881823414111

SubSet 50 average Sharpe Ratio: 0.3963776322093146

Average Sharpe Ratio of all generated: 0.4083487597898014

SubSet 51 average Sharpe Ratio: 0.4536906032013206

Average Sharpe Ratio of all generated: 0.40922071831694595

SubSet 52 average Sharpe Ratio: 0.394130802881091

Average Sharpe Ratio of all generated: 0.4089360029313638

SubSet 53 average Sharpe Ratio: 0.3262246625182274

Average Sharpe Ratio of all generated: 0.40740431144223166

SubSet 54 average Sharpe Ratio: 0.268200185930846

Average Sharpe Ratio of all generated: 0.40487332734202464

SubSet 55 average Sharpe Ratio: 0.3271516074660816

Average Sharpe Ratio of all generated: 0.4034854394870971

SubSet 56 average Sharpe Ratio: 0.4794549258218106

Average Sharpe Ratio of all generated: 0.4048182374929692

SubSet 57 average Sharpe Ratio: 0.3353115738077523

Average Sharpe Ratio of all generated: 0.4036198467397758

SubSet 58 average Sharpe Ratio: 0.4357417729466151

Average Sharpe Ratio of all generated: 0.40416428616701033

SubSet 59 average Sharpe Ratio: 0.2860753193968998

Average Sharpe Ratio of all generated: 0.4021961367208418

SubSet 60 average Sharpe Ratio: 0.4888277907771767

Average Sharpe Ratio of all generated: 0.40361632777094564

SubSet 61 average Sharpe Ratio: 0.38642505209070754

Average Sharpe Ratio of all generated: 0.4033390491309418

SubSet 62 average Sharpe Ratio: 0.419203026663775

Average Sharpe Ratio of all generated: 0.4035908582981297

SubSet 63 average Sharpe Ratio: 0.4064042217237336

Average Sharpe Ratio of all generated: 0.4036348171016547

SubSet 64 average Sharpe Ratio: 0.2621499104223904

Average Sharpe Ratio of all generated: 0.40145812622966603

SubSet 65 average Sharpe Ratio: 0.4214448462597817

Average Sharpe Ratio of all generated: 0.40176095532103145

SubSet 66 average Sharpe Ratio: 0.4536807280653825

Average Sharpe Ratio of all generated: 0.4025358773022904

SubSet 67 average Sharpe Ratio: 0.3994350159625511

Average Sharpe Ratio of all generated: 0.40249027640023544

SubSet 68 average Sharpe Ratio: 0.2074788955902935

Average Sharpe Ratio of all generated: 0.39966402450443916

SubSet 69 average Sharpe Ratio: 0.25847640950346884

Average Sharpe Ratio of all generated: 0.39764705857585386

SubSet 70 average Sharpe Ratio: 0.4107695542112892

Average Sharpe Ratio of all generated: 0.3978318824580431

SubSet 71 average Sharpe Ratio: 0.4302086339099597

Average Sharpe Ratio of all generated: 0.39828155956154193

SubSet 72 average Sharpe Ratio: 0.3664952076659213

Average Sharpe Ratio of all generated: 0.3978461300835197

SubSet 73 average Sharpe Ratio: 0.495948541293731

Average Sharpe Ratio of all generated: 0.3991718383431172

SubSet 74 average Sharpe Ratio: 0.2827655419464653

Average Sharpe Ratio of all generated: 0.3976197543911619

SubSet 75 average Sharpe Ratio: 0.2889523870240499

Average Sharpe Ratio of all generated: 0.3961899206100157

SubSet 76 average Sharpe Ratio: 0.4510107029003185

Average Sharpe Ratio of all generated: 0.39690187882157807

SubSet 77 average Sharpe Ratio: 0.1684038166762066

Average Sharpe Ratio of all generated: 0.39397241648638104

SubSet 78 average Sharpe Ratio: 0.34641769390890054

Average Sharpe Ratio of all generated: 0.39337045797274206

SubSet 79 average Sharpe Ratio: 0.45200142223181966

Average Sharpe Ratio of all generated: 0.39410334502598054

SubSet 80 average Sharpe Ratio: 0.4592047796571303

Average Sharpe Ratio of all generated: 0.39490706644117995

SubSet 81 average Sharpe Ratio: 0.5162445717934961

Average Sharpe Ratio of all generated: 0.3963867921162082

SubSet 82 average Sharpe Ratio: 0.41913313098513294

Average Sharpe Ratio of all generated: 0.3966608443917374

SubSet 83 average Sharpe Ratio: 0.3663473596483265

Average Sharpe Ratio of all generated: 0.3962999695733635

SubSet 84 average Sharpe Ratio: 0.309630370953619

Average Sharpe Ratio of all generated: 0.3952803272366606

SubSet 85 average Sharpe Ratio: 0.3359489506631254

Average Sharpe Ratio of all generated: 0.39459042750906137

SubSet 86 average Sharpe Ratio: 0.30935185614171384

Average Sharpe Ratio of all generated: 0.39361067381518383

SubSet 87 average Sharpe Ratio: 0.46643547509617234

Average Sharpe Ratio of all generated: 0.39443822837519504

SubSet 88 average Sharpe Ratio: 0.308046516600548

Average Sharpe Ratio of all generated: 0.3934675349844687

SubSet 89 average Sharpe Ratio: 0.37110569346733596

Average Sharpe Ratio of all generated: 0.3932190700787227

SubSet 90 average Sharpe Ratio: 0.5000341721589078

Average Sharpe Ratio of all generated: 0.3943928624092742

SubSet 91 average Sharpe Ratio: 0.487759088435703

Average Sharpe Ratio of all generated: 0.3954077126921701

SubSet 92 average Sharpe Ratio: 0.5033508426937997

Average Sharpe Ratio of all generated: 0.39656839150939194

SubSet 93 average Sharpe Ratio: 0.3271445745622307

Average Sharpe Ratio of all generated: 0.39582984026527324

SubSet 94 average Sharpe Ratio: 0.4549143343062583

Average Sharpe Ratio of all generated: 0.3964517823078099

SubSet 95 average Sharpe Ratio: 0.3722912365571014

Average Sharpe Ratio of all generated: 0.39620010995624005

SubSet 96 average Sharpe Ratio: 0.4432285521249588

Average Sharpe Ratio of all generated: 0.3966849392569485

SubSet 97 average Sharpe Ratio: 0.377793048966472

Average Sharpe Ratio of all generated: 0.39649216486622935

SubSet 98 average Sharpe Ratio: 0.26566843812112745

Average Sharpe Ratio of all generated: 0.3951707130809253

SubSet 99 average Sharpe Ratio: 0.4162440004376693

Average Sharpe Ratio of all generated: 0.39538144595449276

Search with Classical Algorithms#

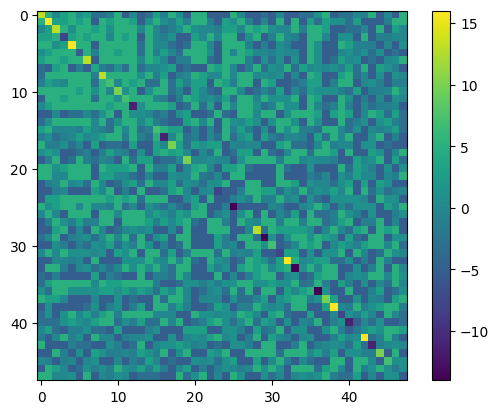

The subsequent step is to prepare the QUBO matrix and implement the functions required for the classical algorithm. Here, the pairwise correlation matrix is computed with logarithmic returns, as following the paper.

import heapq

import pandas as pd

import copy

#Attractiveness Coversion

def SRBucket(SR_list):

Buckets=sorted(SR_list)

Buckets.reverse()

GroupedList = list(np.array_split(Buckets,11))

for i in range(len(SR_list)):

if SR_list[i] in GroupedList[0]: SR_list[i]=15

elif SR_list[i] in GroupedList[1]: SR_list[i]=12

elif SR_list[i] in GroupedList[2]: SR_list[i]=9

elif SR_list[i] in GroupedList[3]: SR_list[i]=6

elif SR_list[i] in GroupedList[4]: SR_list[i]=3

elif SR_list[i] in GroupedList[5]: SR_list[i]=0

elif SR_list[i] in GroupedList[6]: SR_list[i]=-3

elif SR_list[i] in GroupedList[7]: SR_list[i]=-6

elif SR_list[i] in GroupedList[8]: SR_list[i]=-9

elif SR_list[i] in GroupedList[9]: SR_list[i]=-12

elif SR_list[i] in GroupedList[10]: SR_list[i]=-15

#Penalty/Reward Conversion

def CorrelationBucket(Corr):

for i in range(len(Corr)):

for j in range(len(Corr)):

if Corr[i][j] >= -1.00 and Corr[i][j] < -0.25: Corr[i][j] = -5

elif Corr[i][j] >= -0.25 and Corr[i][j] < -0.15: Corr[i][j] = -3

elif Corr[i][j] >= -0.15 and Corr[i][j] < -0.05: Corr[i][j] = -1

elif Corr[i][j] >= -0.05 and Corr[i][j] < 0.05: Corr[i][j] = 0

elif Corr[i][j] >= 0.05 and Corr[i][j] < 0.15: Corr[i][j] = 1

elif Corr[i][j] >= 0.15 and Corr[i][j] < 0.25: Corr[i][j] = 3

elif Corr[i][j] >= 0.25 and Corr[i][j] < 1.00: Corr[i][j] = 5

#Ising component for classical algorithms

def hi(SR_list, Corr, i):

h = 0.5*SR_list[i] + np.sum(Corr[i])

return h

def jij(Corr, i, j):

return 1./4.*Corr[i][j]

#Create Pairwise Correlation Matrix

def CreateCorrMat(Chart):

assets = list()

for iasset in range(len(Chart)):

returns = list()

for month in range(12):

log_return = np.log(Chart[iasset][month+1]/Chart[iasset][month])

returns.append(log_return)

assets.append(returns)

Chart_pd = pd.DataFrame(assets).T

pairwise_corr = Chart_pd.corr(method='pearson')

return pairwise_corr

#Initial state for Greedy Search and Genetic Algorithm

def GenerateRandomSolution(Nassets):

Solution = np.random.randint(2, size=Nassets)

for i in range(Nassets):

Solution[i] = 2*Solution[i] - 1

return Solution

# compute Sharpe ratio from obtained portfolio

def EvaluateSolution(Solution,Chart):

selected_assets = list()

for i in range(len(Solution)):

if Solution[i] == 1:

selected_assets.append(Chart[i])

portfolioChart = np.mean(selected_assets, axis=0)

portfolioSR = CalculateSharpeRatio(portfolioChart)

return portfolioSR

# introduce mutations to make next generation in genetic algorithm

def CreateDescendant(Ancestor, Ndescendants, MaxMutation):

n = 0

index_list = range(len(Ancestor))

Descendants = list()

while n < Ndescendants:

Nmutaion = np.random.randint(MaxMutation)

Place_to_change = np.random.choice(index_list, size=Nmutaion, replace=False)

Descendant = list()

for place in Place_to_change:

Descendant = copy.deepcopy(Ancestor)

Descendant[place] = Ancestor[place] * -1

Descendants.append(Descendant)

n += 1

return Descendants

# regenerate set of assets

# we use this set of assets from here

Nassets = 48

Chart = CreateAssets(Nassets)

PairwiseCorrMat = CreateCorrMat(Chart)

SR_list = list()

for asset in Chart:

SR_list.append(CalculateSharpeRatio(asset))

# convert from Bucket

SRBucket(SR_list)

CorrelationBucket(PairwiseCorrMat)

#print(PairwiseCorrMat) # display pairwise correlation matrix

Greedy Method#

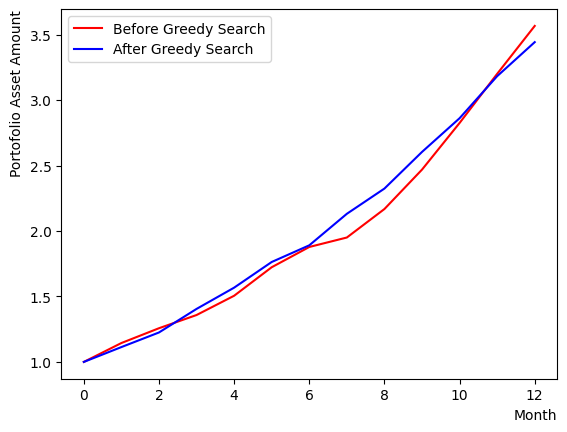

First, we conduct a greedy search algorithm. Commencing from a randomly generated initial state, we select stocks that are likely to increase the Sharpe ratio of the portfolio, by examining their impact on overall performance. By iterating, we can observe that the algorithm converges from a random initial state to a particular state.

After execution, we compare the initial state with the state obtained by the greedy method. The reference of comparison is the Sharpe Ratio of the portfolio. In this tutorial, the calculation is based on the scenario where all stocks have the same weight, thus the average chart of the selected stocks is used to calculate the Sharpe ratio. We can also observe that if we reset the set of stocks by running the previous code block multiple times, the results of the greedy method may be inferior to the initial state or remain almost unchanged.

There also appear final states where the final returns are inferior to the initial state, but the Sharpe Ratio is larger. Comparing these final states, we can see that the portfolio with a larger Sharpe ratio has a smoother chart and smaller fluctuations (less risky).

#Greedy Search

# generate initial state

Solution = GenerateRandomSolution(Nassets)

print("Initial random selection:")

print(Solution, EvaluateSolution(Solution, Chart))

print("")

selected_charts = list()

for i in range(Nassets):

if Solution[i] == 1:

selected_charts.append(Chart[i])

portfolioChart = np.mean(selected_charts, axis=0)

# initialize energy based on initial state

Energies = list()

for iasset in range(Nassets):

h = hi(SR_list, PairwiseCorrMat, iasset)

energyTuple = [-1*abs(h), h , iasset]

Energies.append(energyTuple)

# execute greedy search

NGreedyLoop = 10

for i in range(NGreedyLoop):

heapq.heapify(Energies)

ntry = 0

#print(Energies) # display energy change

while(ntry < len(Energies)):

x, e, i = heapq.heappop(Energies)

if e > 0:

Solution[i] = -1.

else:

Solution[i] = 1.

for ie in Energies:

n = ie[2]

ie[1] = ie[1] + Solution[i]*(jij(PairwiseCorrMat, i, n) + jij(PairwiseCorrMat, n, i))

ie[0] = -ie[1]

ntry+=1

# output of greedy search

print("Selection After Greedy Search:")

print(Solution, EvaluateSolution(Solution, Chart))

print("")

selected_charts2 = list()

for i in range(Nassets):

if Solution[i] == 1:

selected_charts2.append(Chart[i])

portfolioChart2 = np.mean(selected_charts2, axis=0)

plt.plot(list(range(13)), portfolioChart,color="r",label="Before Greedy Search")

plt.plot(list(range(13)), portfolioChart2,color="b",label="After Greedy Search")

plt.xlabel("Month", loc="right")

plt.ylabel("Portofolio Asset Amount", loc="top")

plt.legend()

plt.show()

Initial random selection:

[ 1 1 1 -1 -1 -1 -1 1 1 1 -1 1 1 1 -1 -1 1 1 -1 1 1 -1 -1 1

1 -1 -1 -1 -1 -1 1 1 -1 1 1 1 -1 1 1 1 -1 -1 1 -1 -1 -1 -1 -1] 3.018178347830132

Selection After Greedy Search:

[ 1 -1 -1 -1 -1 -1 -1 1 -1 -1 -1 -1 -1 1 -1 -1 1 1 1 1 1 1 1 1

-1 1 -1 -1 -1 -1 1 -1 1 -1 1 -1 -1 1 1 -1 1 1 1 1 -1 1 -1 1] 4.45844050991915

Genetic Algorithm#

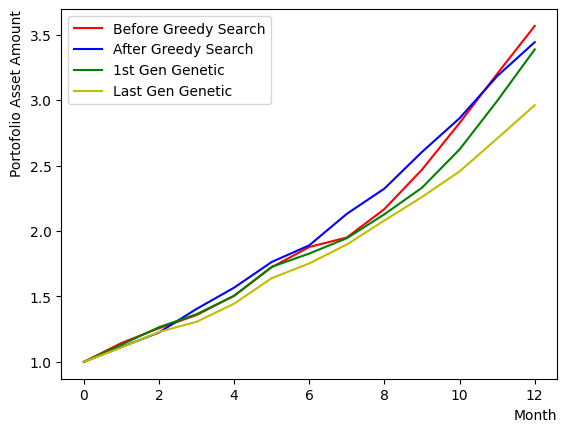

An alternate classical algorithm to the greedy method is the genetic algorithm. It selects the most optimal solution from a number of randomly generated portfolios and generates the next iteration of portfolios based on that optimal solution. The subsequent step of portfolios is generated through mutations that introduce random modifications to the previous step portfolios, and through crossover which exchanges genetic traits between portfolios. Given the relatively small number of stocks in this scenario, we only consider mutations and abstain from genetic crossover. By comparing the results, it is evident that the performance of the final computed generation surpasses that of the initial one. As the number of iterations attempted here is limited, performance may not improve or the improvement may be trivial. However, it is also apparent that, in general, the output is more stable than that of the greedy method.

Note: Increasing the number of genetic pairs, the number of offspring, and the number of mutations may result in an increase in computational complexity, causing the calculation to not be completed. Therefore, please adjust the settings according to your execution environment.

#Genetic Algorithm

Ngenes = 10 # the number of pairs of genes

NGenerations = 5 # the number of generations

# initialize randomly

Genes = list()

for i in range(Ngenes):

gene = GenerateRandomSolution(Nassets)

geneSR = EvaluateSolution(gene, Chart)

Genes.append([geneSR, gene])

Genes = sorted(Genes,reverse=True)

# get the best portfolio in first generation

print("Best Gene 1st generation:")

print(Genes[0][1], EvaluateSolution(Genes[0][1], Chart))

print("")

selected_charts3 = list()

for i in range(Nassets):

if Genes[0][1][i] == 1:

selected_charts3.append(Chart[i])

portfolioChart3 = np.mean(selected_charts3, axis=0)

# execute genetic algorithm

K_best = 5 # the number of top genes which are extracted

Ndescendants = 2 # the number of offspring

MaxMutation = 2 # the maximum number of mutations

for iIter in range(NGenerations):

selected_Genes = Genes[:K_best]

for gene in selected_Genes:

Descendants = CreateDescendant(gene[1], Ndescendants, MaxMutation)

for Descendant in Descendants:

DescendantSR = EvaluateSolution(Descendant, Chart)

selected_Genes.append([DescendantSR, Descendant])

selected_Genes = sorted(selected_Genes, key=lambda x: x[0], reverse=True)

selected_Genes = copy.deepcopy(selected_Genes[:K_best])

# get the best portfolio in the final generation

print("Best Gene last generation:")

print(selected_Genes[0][1], EvaluateSolution(selected_Genes[0][1], Chart))

print("")

selected_charts4 = list()

for i in range(Nassets):

if selected_Genes[0][1][i] == 1:

selected_charts4.append(Chart[i])

portfolioChart4 = np.mean(selected_charts4, axis=0)

# make a comparison plot

plt.plot(list(range(13)), portfolioChart,color="r",label="Before Greedy Search")

plt.plot(list(range(13)), portfolioChart2,color="b",label="After Greedy Search")

plt.plot(list(range(13)), portfolioChart3,color="g",label="1st Gen Genetic")

plt.plot(list(range(13)), portfolioChart4,color="y",label="Last Gen Genetic")

plt.xlabel("Month", loc="right")

plt.ylabel("Portofolio Asset Amount", loc="top")

plt.legend()

plt.show()

Best Gene 1st generation:

[ 1 -1 -1 -1 -1 -1 -1 1 -1 1 1 1 -1 -1 1 -1 -1 -1 1 1 1 1 1 -1

1 1 1 1 -1 1 -1 -1 1 -1 -1 1 -1 1 -1 1 -1 1 1 1 -1 -1 1 1] 3.1009991529339853

Best Gene last generation:

[ 1 1 -1 -1 -1 1 -1 1 1 -1 -1 -1 -1 -1 -1 1 1 -1 -1 -1 1 1 1 1

-1 1 1 1 1 1 1 -1 1 -1 1 -1 -1 -1 1 -1 1 1 -1 1 1 1 -1 1] 4.126525652941457

Implementation of quantum annealing method using OpenJij#

Method for quantum annealing#

To solve the optimization problem in reverse quantum annealing, we will translate the classical algorithm’s spin-form results into the formulation used in quantum annealing.

def ConvertSolutionToQuboState(solution):

output = list()

for i in range(len(solution)):

if solution[i] == 1:

output.append(1)

else: output.append(0)

return output

QA_init_state = ConvertSolutionToQuboState(Solution) # use the result from greedy search as an initial state

#QA_init_state = ConvertSolutionToQuboState(selected_Genes[0][1]) # use the best portfolio in the final generation of genetic algorithm as an initial state

#QA_init_state = GenerateRandomSolution(Nassets) # use random initial state

print(QA_init_state)

[1, 0, 0, 0, 0, 0, 0, 1, 0, 0, 0, 0, 0, 1, 0, 0, 1, 1, 1, 1, 1, 1, 1, 1, 0, 1, 0, 0, 0, 0, 1, 0, 1, 0, 1, 0, 0, 1, 1, 0, 1, 1, 1, 1, 0, 1, 0, 1]

For forward annealing#

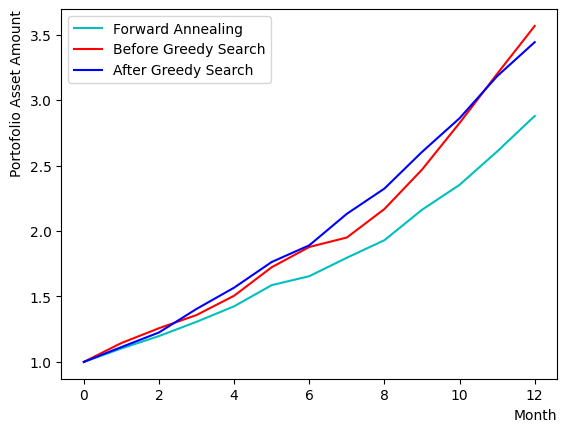

Initially, we will execute Forward Annealing. We construct a QUBO matrix incorporating the stocks’ attractiveness and the pairwise correlations of penalties and rewards. In this following, we perform our computations through Simulated Quantum Annealing (SQA), which emulates quantum annealing on a classical computer. The enhancement in the final rate of return varies based on the case, yet we can observe that the charts demonstrate greater stability than the results procured by the greedy method.

from openjij import SQASampler

sampler = SQASampler()

QUBO = np.random.rand(Nassets**2).reshape(Nassets, Nassets)

for i in range(Nassets):

for j in range(Nassets):

QUBO[i][j] = PairwiseCorrMat[i][j]

for i in range(Nassets):

QUBO[i][i] = QUBO[i][i] + SR_list[i]

print(type(QUBO))

import matplotlib.pyplot as plt

plt.imshow(QUBO)

plt.colorbar()

plt.show()

sampleset_FQA = sampler.sample_qubo(QUBO,num_reads=10)

print(sampleset_FQA.record)

print(sampleset_FQA.record[0][0], EvaluateSolution(sampleset_FQA.record[0][0], Chart))

selected_charts = list()

for i in range(Nassets):

if sampleset_FQA.record[0][0][i]:

selected_charts.append(Chart[i])

portfolioChart_FQA = np.mean(selected_charts, axis=0)

plt.plot(list(range(13)), portfolioChart_FQA, color="c", label="Forward Annealing")

plt.plot(list(range(13)), portfolioChart,color="r",label="Before Greedy Search")

plt.plot(list(range(13)), portfolioChart2,color="b",label="After Greedy Search")

plt.xlabel("Month", loc="right")

plt.ylabel("Portofolio Asset Amount", loc="top")

plt.legend()

plt.show()

<class 'numpy.ndarray'>

[([1, 0, 0, 0, 0, 1, 0, 1, 0, 0, 0, 0, 0, 1, 1, 0, 1, 1, 0, 0, 1, 1, 1, 1, 1, 1, 1, 0, 0, 1, 1, 0, 1, 1, 1, 0, 1, 1, 0, 1, 1, 1, 1, 1, 0, 1, 1, 1], -397., 1)

([1, 0, 0, 0, 0, 1, 0, 1, 0, 0, 0, 0, 0, 1, 1, 0, 1, 1, 0, 0, 1, 1, 1, 1, 1, 1, 1, 0, 0, 1, 1, 0, 1, 1, 1, 0, 1, 1, 0, 1, 1, 1, 1, 1, 0, 1, 1, 1], -397., 1)

([1, 0, 0, 0, 0, 1, 0, 1, 0, 0, 0, 0, 0, 1, 1, 0, 1, 1, 0, 0, 1, 1, 1, 1, 1, 1, 1, 0, 0, 1, 1, 0, 1, 1, 1, 0, 1, 1, 0, 1, 1, 1, 1, 1, 0, 1, 1, 1], -397., 1)

([1, 0, 0, 0, 0, 1, 0, 1, 0, 0, 0, 0, 0, 1, 1, 0, 1, 1, 0, 0, 1, 1, 1, 1, 1, 1, 1, 0, 0, 1, 1, 0, 1, 1, 1, 0, 1, 1, 0, 1, 1, 1, 1, 1, 0, 1, 1, 1], -397., 1)

([1, 0, 0, 0, 0, 1, 0, 1, 0, 0, 0, 0, 0, 1, 1, 0, 1, 1, 0, 0, 1, 1, 1, 1, 1, 1, 1, 0, 0, 1, 1, 0, 1, 1, 1, 0, 1, 1, 0, 1, 1, 1, 1, 1, 0, 1, 1, 1], -397., 1)

([1, 0, 0, 0, 0, 1, 0, 1, 0, 0, 0, 0, 0, 1, 1, 0, 1, 1, 0, 0, 1, 1, 1, 1, 1, 1, 1, 0, 0, 1, 1, 0, 1, 1, 1, 0, 1, 1, 0, 1, 1, 1, 1, 1, 0, 1, 1, 1], -397., 1)

([1, 0, 0, 0, 0, 1, 0, 1, 0, 0, 0, 0, 0, 1, 1, 0, 1, 1, 0, 0, 1, 1, 1, 1, 1, 1, 1, 0, 0, 1, 1, 0, 1, 1, 1, 0, 1, 1, 0, 1, 1, 1, 1, 1, 0, 1, 1, 1], -397., 1)

([1, 0, 0, 0, 0, 1, 0, 1, 0, 0, 0, 0, 0, 1, 1, 0, 1, 1, 0, 0, 1, 1, 1, 1, 1, 1, 1, 0, 0, 1, 1, 0, 1, 1, 1, 0, 1, 1, 0, 1, 1, 1, 1, 1, 0, 1, 1, 1], -397., 1)

([1, 0, 0, 0, 0, 1, 0, 1, 0, 0, 0, 0, 0, 1, 1, 0, 1, 1, 0, 0, 1, 1, 1, 1, 1, 1, 1, 0, 0, 1, 1, 0, 1, 1, 1, 0, 1, 1, 0, 1, 1, 1, 1, 1, 0, 1, 1, 1], -397., 1)

([1, 0, 0, 0, 0, 1, 0, 1, 0, 0, 0, 0, 0, 1, 1, 0, 1, 1, 0, 0, 1, 1, 1, 1, 1, 1, 1, 0, 0, 1, 1, 0, 1, 1, 1, 0, 1, 1, 0, 1, 1, 1, 1, 1, 0, 1, 1, 1], -397., 1)]

[1 0 0 0 0 1 0 1 0 0 0 0 0 1 1 0 1 1 0 0 1 1 1 1 1 1 1 0 0 1 1 0 1 1 1 0 1

1 0 1 1 1 1 1 0 1 1 1] 3.7873836272238077

For reverse quantum annealing#

In reverse annealing, we input the state generated from the classical algorithm as the initial state before annealing. The first step is to set up the annealing schedule. In this tutorial, using OpenJij, the SQA Hamiltonian is defined as follows:

where is the problem Hamiltonian that we seek to obtain the optimal solution for, and and correspond to and in reference paper [2] respectively.

The value of can be set by adding supplementary arguments to sample_qubo.

sample_qubo(QUBO, num_reads=10)

We can modify the previous section’s sample_qubo to input the initial state settings and updates as follows:

sample_qubo(QUBO, schedule = user_schedule, initial_state = user_initial_state, num_reads=10, reinitialize_state = False)

where the schedule refers to the annealing schedule.

It has the following structure: [0] component represents the value of , reflecting the transverse magnetic field’s intensity during annealing;

[1] component is the inverse temperature , with a larger value denoting a lower temperature, facilitating the attainment of the ground state (default value of );

and [2] component denotes the number of quantum Monte Carlo simulation steps, enabling us to alter the length of each schedule.

The initial state should be assigned to the initial_state argument.

If the reinitialize_state option is set to False, the previous step’s annealing output is designated as the next step’s annealing initial state in the iteration.

In the sample script above, commencing from the classical algorithm’s prepared initial state, RQA would execute ten times.

The default of the optional argument, True, reset the initial state every time it runs;

if we want to execute RQA once and contrast the results multiple times, we set reinitialize_state = True.

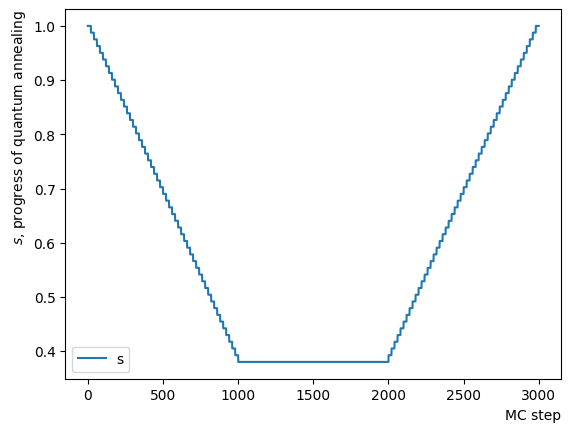

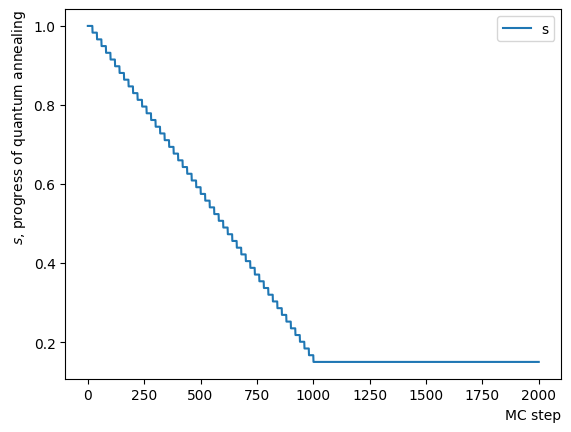

Now, let’s fabricate a schedule for reverse annealing. Since OpenJij sampler performs quantum Monte Carlo with a given and over a specified number of MC steps, we need to create a schedule in which and gradually change by linking short constants to facilitate RQA’s functionality. Here, we focus on the change in and plot it to observe an inverted trapezoidal schedule. The horizontal axis represents the quantum Monte Carlo method’s number of Monte Carlo steps. By rewriting the schedule creation function’s contents, we can generate any schedule shapes.

def ScheduleFunction(x, RQAschedule):

for step in RQAschedule:

length = step[2]

if x - length > 0:

x = x-length

continue

else:

s = step[0]

return s

def ConvertScheduleToPlot(RQAschedule):

TotalLength = np.sum(RQAschedule, axis=0)[2]

x = np.arange(0, TotalLength+1)

s = [ScheduleFunction(n, RQAschedule) for n in x]

plt.plot(x, s ,label="s")

plt.xlabel("MC step", loc="right")

plt.ylabel("$s$, progress of quantum annealing", loc="top")

plt.legend()

plt.show()

#Create RQA schedule

RQAschedule = []

NReverseStep = 50

NPauseStep = 50

NForwardStep = 50

NMCStep = 20

TargetS = 0.38

ReverseStep = (1.0 - TargetS) / NReverseStep

ForwardStep = (1.0 - TargetS) / NForwardStep

beta = 5.

#Reverse Step

for i in range(NReverseStep):

step_sche = [1.0-i*ReverseStep, beta, NMCStep]

RQAschedule.append(step_sche)

#Pause Step

RQAschedule.append([TargetS, beta, NPauseStep*NMCStep])

#Forward Step

for i in range(NForwardStep):

step_sche = [TargetS+(i+1)*ForwardStep, beta, NMCStep]

RQAschedule.append(step_sche)

#Plot Annealing Schedule

ConvertScheduleToPlot(RQAschedule)

Let’s execute the RQA utilizing the sample_qubo function in conjunction with the schedule and initial conditions set up thus far.

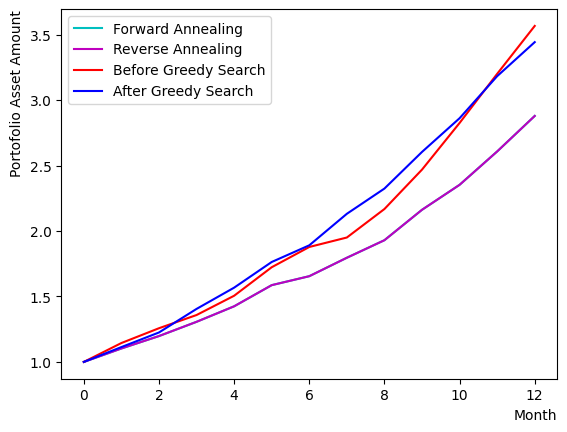

Simultaneously, we compare the outcomes of the greedy method, forward annealing, and RQA.

The results indicate that the setup in this tutorial frequently yields the same optimal solution as forward annealing, owing to the constraints imposed by the size of the set of assets.

# prepare initial state

init_state = QA_init_state

#Reverse Annealing

sampleset_RQA = sampler.sample_qubo(QUBO, schedule=RQAschedule, initial_state = init_state, num_reads=10, reinitialize_state=False)

print(sampleset_RQA.record)

# compare charts

selected_charts = list()

for i in range(Nassets):

if sampleset_RQA.record[0][0][i]:

selected_charts.append(Chart[i])

portfolioChart_RQA = np.mean(selected_charts, axis=0)

plt.plot(list(range(13)), portfolioChart_FQA, color="c", label="Forward Annealing")

plt.plot(list(range(13)), portfolioChart_RQA, color="m", label="Reverse Annealing")

plt.plot(list(range(13)), portfolioChart,color="r",label="Before Greedy Search")

plt.plot(list(range(13)), portfolioChart2,color="b",label="After Greedy Search")

plt.xlabel("Month", loc="right")

plt.ylabel("Portofolio Asset Amount", loc="top")

plt.legend()

plt.show()

# compare the results

print("Forward Quantum Annealing Result:")

print(sampleset_FQA.record[0][0], EvaluateSolution(sampleset_FQA.record[0][0], Chart))

print("Reverse Quantum Annealing Result:")

print(sampleset_RQA.record[0][0], EvaluateSolution(sampleset_RQA.record[0][0], Chart))

[([1, 0, 0, 0, 0, 1, 0, 1, 0, 0, 0, 0, 0, 1, 1, 0, 1, 1, 0, 0, 1, 1, 1, 1, 1, 1, 1, 0, 0, 1, 1, 0, 1, 1, 1, 0, 1, 1, 0, 1, 1, 1, 1, 1, 0, 1, 1, 1], -397., 1)

([1, 0, 0, 0, 0, 1, 0, 1, 0, 0, 0, 0, 0, 1, 1, 0, 1, 1, 0, 0, 1, 1, 1, 1, 1, 1, 1, 0, 0, 1, 1, 0, 1, 1, 1, 0, 1, 1, 0, 1, 1, 1, 1, 1, 0, 1, 1, 1], -397., 1)

([1, 0, 0, 0, 0, 1, 0, 1, 0, 0, 0, 0, 0, 1, 1, 0, 1, 1, 0, 0, 1, 1, 1, 1, 1, 1, 1, 0, 0, 1, 1, 0, 1, 1, 1, 0, 1, 1, 0, 1, 1, 1, 1, 1, 0, 1, 1, 1], -397., 1)

([1, 0, 0, 0, 0, 1, 0, 1, 0, 0, 0, 0, 0, 1, 1, 0, 1, 1, 0, 0, 1, 1, 1, 1, 1, 1, 1, 0, 0, 1, 1, 0, 1, 1, 1, 0, 1, 1, 0, 1, 1, 1, 1, 1, 0, 1, 1, 1], -397., 1)

([1, 0, 0, 0, 0, 1, 0, 1, 0, 0, 0, 0, 0, 1, 1, 0, 1, 1, 0, 0, 1, 1, 1, 1, 1, 1, 1, 0, 0, 1, 1, 0, 1, 1, 1, 0, 1, 1, 0, 1, 1, 1, 1, 1, 0, 1, 1, 1], -397., 1)

([1, 0, 0, 0, 0, 1, 0, 1, 0, 0, 0, 0, 0, 1, 1, 0, 1, 1, 0, 0, 1, 1, 1, 1, 1, 1, 1, 0, 0, 1, 1, 0, 1, 1, 1, 0, 1, 1, 0, 1, 1, 1, 1, 1, 0, 1, 1, 1], -397., 1)

([1, 0, 0, 0, 0, 1, 0, 1, 0, 0, 0, 0, 0, 1, 1, 0, 1, 1, 0, 0, 1, 1, 1, 1, 1, 1, 1, 0, 0, 1, 1, 0, 1, 1, 1, 0, 1, 1, 0, 1, 1, 1, 1, 1, 0, 1, 1, 1], -397., 1)

([1, 0, 0, 0, 0, 1, 0, 1, 0, 0, 0, 0, 0, 1, 1, 0, 1, 1, 0, 0, 1, 1, 1, 1, 1, 1, 1, 0, 0, 1, 1, 0, 1, 1, 1, 0, 1, 1, 0, 1, 1, 1, 1, 1, 0, 1, 1, 1], -397., 1)

([1, 0, 0, 0, 0, 1, 0, 1, 0, 0, 0, 0, 0, 1, 1, 0, 1, 1, 0, 0, 1, 1, 1, 1, 1, 1, 1, 0, 0, 1, 1, 0, 1, 1, 1, 0, 1, 1, 0, 1, 1, 1, 1, 1, 0, 1, 1, 1], -397., 1)

([1, 0, 0, 0, 0, 1, 0, 1, 0, 0, 0, 0, 0, 1, 1, 0, 1, 1, 0, 0, 1, 1, 1, 1, 1, 1, 1, 0, 0, 1, 1, 0, 1, 1, 1, 0, 1, 1, 0, 1, 1, 1, 1, 1, 0, 1, 1, 1], -397., 1)]

Forward Quantum Annealing Result:

[1 0 0 0 0 1 0 1 0 0 0 0 0 1 1 0 1 1 0 0 1 1 1 1 1 1 1 0 0 1 1 0 1 1 1 0 1

1 0 1 1 1 1 1 0 1 1 1] 3.7873836272238077

Reverse Quantum Annealing Result:

[1 0 0 0 0 1 0 1 0 0 0 0 0 1 1 0 1 1 0 0 1 1 1 1 1 1 1 0 0 1 1 0 1 1 1 0 1

1 0 1 1 1 1 1 0 1 1 1] 3.7873836272238077

Checking reverse quantum annealing#

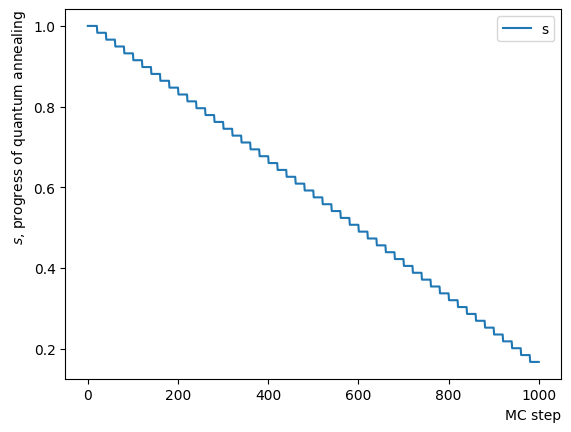

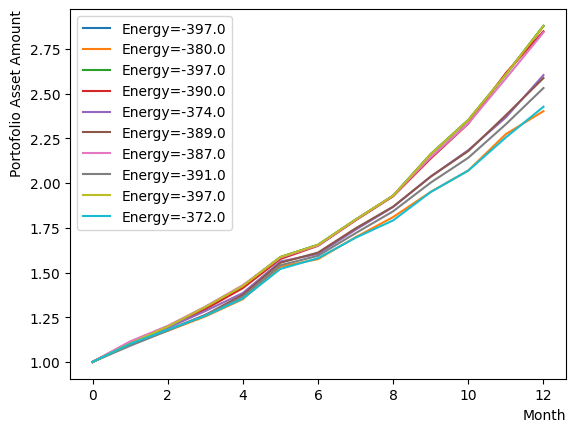

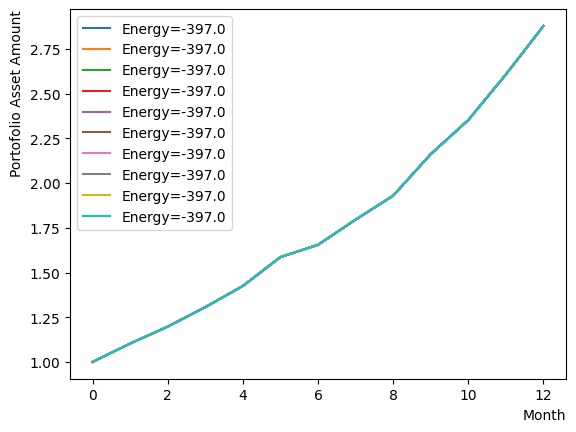

Since the final output alone fails to provide insight into the behavior of RQA, we dissect the phase and observe its behavior. Initially, we investigate the reverse phase. Similarly, an annealing schedule is set up and annealing is carried out using the designated schedule and initial state. Here, for clarity, we have altered the value and inverse temperature at which the reverse phase terminates. Additionally, annealing is arranged to commence from the same initial state on each occasion, as opposed to undergoing iteration. The results show that the reverse phase process ascends from the previously attained solution to a higher energy state. Furthermore, as the solution stays in a different state during each execution, we can deduce that the solution differs at a higher energy level.

#Create RQA schedule

RQAschedule = []

NReverseStep = 50

TargetS = 0.15 # return to more random state よりランダムな状態に戻す

ReverseStep = (1.0 - TargetS) / NReverseStep

beta = 5.0

MC_step = 20

#Reverse Step

for i in range(NReverseStep):

step_sche = [1.0-i*ReverseStep, beta, MC_step]

RQAschedule.append(step_sche)

ConvertScheduleToPlot(RQAschedule)

init_state = QA_init_state

sampleset_RQA_Reverse = sampler.sample_qubo(QUBO, schedule=RQAschedule, initial_state = init_state, num_reads=10, reinitialize_state=True) #毎回同じ初期状態からアニーリング

for state in sampleset_RQA_Reverse.record:

selected_charts = list()

for i in range(Nassets):

if state[0][i]:

selected_charts.append(Chart[i])

portfolioChart = np.mean(selected_charts, axis=0)

plt.plot(list(range(13)), portfolioChart, label=("Energy="+str(state[1])))

plt.xlabel("Month", loc="right")

plt.ylabel("Portofolio Asset Amount", loc="top")

plt.legend()

plt.show()

print(sampleset_RQA_Reverse.record)

[([1, 0, 0, 0, 0, 1, 0, 1, 0, 0, 0, 0, 0, 1, 1, 0, 1, 1, 0, 0, 1, 1, 1, 1, 1, 1, 1, 0, 0, 1, 1, 0, 1, 1, 1, 0, 1, 1, 0, 1, 1, 1, 1, 1, 0, 1, 1, 1], -397., 1)

([1, 0, 0, 0, 0, 1, 0, 1, 0, 0, 0, 0, 1, 1, 0, 0, 1, 1, 0, 1, 1, 1, 1, 1, 1, 1, 0, 0, 0, 1, 0, 0, 0, 1, 1, 0, 1, 1, 0, 1, 1, 1, 0, 1, 0, 1, 1, 1], -380., 1)

([1, 0, 0, 0, 0, 1, 0, 1, 0, 0, 0, 0, 0, 1, 1, 0, 1, 1, 0, 0, 1, 1, 1, 1, 1, 1, 1, 0, 0, 1, 1, 0, 1, 1, 1, 0, 1, 1, 0, 1, 1, 1, 1, 1, 0, 1, 1, 1], -397., 1)

([1, 0, 0, 0, 0, 1, 0, 1, 0, 0, 0, 0, 0, 1, 1, 1, 1, 1, 0, 1, 1, 1, 1, 1, 1, 1, 1, 0, 1, 1, 0, 0, 0, 1, 1, 0, 1, 1, 0, 1, 1, 1, 1, 1, 0, 1, 1, 1], -390., 1)

([1, 0, 0, 0, 0, 1, 0, 1, 0, 0, 0, 0, 0, 1, 1, 0, 1, 1, 0, 0, 1, 1, 1, 1, 1, 1, 0, 0, 0, 1, 1, 0, 1, 1, 1, 1, 0, 1, 0, 1, 1, 1, 0, 1, 0, 1, 0, 1], -374., 1)

([1, 0, 0, 0, 0, 1, 0, 1, 0, 0, 0, 0, 0, 1, 1, 0, 1, 1, 0, 0, 1, 1, 1, 1, 1, 1, 1, 0, 0, 1, 1, 0, 1, 1, 1, 0, 0, 1, 0, 1, 1, 1, 0, 1, 0, 1, 1, 1], -389., 1)

([1, 0, 0, 0, 0, 1, 0, 1, 0, 0, 0, 0, 0, 1, 1, 0, 1, 1, 0, 0, 1, 1, 1, 1, 1, 1, 1, 0, 1, 1, 0, 0, 1, 1, 1, 0, 1, 1, 0, 1, 1, 1, 1, 1, 0, 1, 1, 1], -387., 1)

([1, 0, 0, 0, 0, 1, 0, 1, 0, 0, 0, 0, 0, 1, 1, 0, 1, 1, 0, 0, 1, 1, 1, 1, 1, 1, 1, 0, 0, 1, 1, 0, 1, 1, 1, 0, 1, 1, 0, 1, 1, 1, 0, 1, 0, 1, 1, 1], -391., 1)

([1, 0, 0, 0, 0, 1, 0, 1, 0, 0, 0, 0, 0, 1, 1, 0, 1, 1, 0, 0, 1, 1, 1, 1, 1, 1, 1, 0, 0, 1, 1, 0, 1, 1, 1, 0, 1, 1, 0, 1, 1, 1, 1, 1, 0, 1, 1, 1], -397., 1)

([1, 0, 0, 0, 0, 1, 0, 1, 0, 0, 0, 0, 0, 1, 1, 0, 1, 1, 0, 0, 1, 1, 1, 1, 1, 1, 1, 0, 1, 1, 1, 1, 0, 1, 1, 0, 1, 1, 0, 1, 1, 1, 0, 1, 0, 1, 1, 1], -372., 1)]

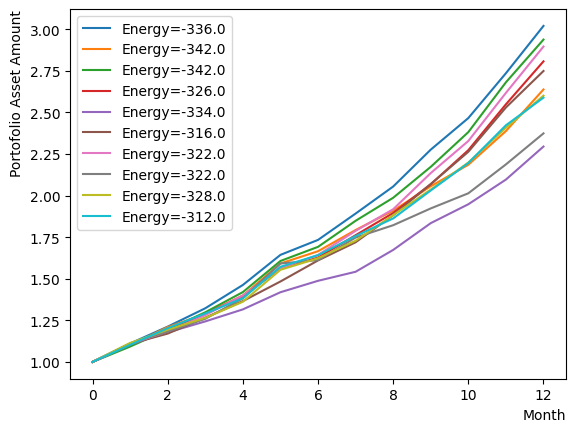

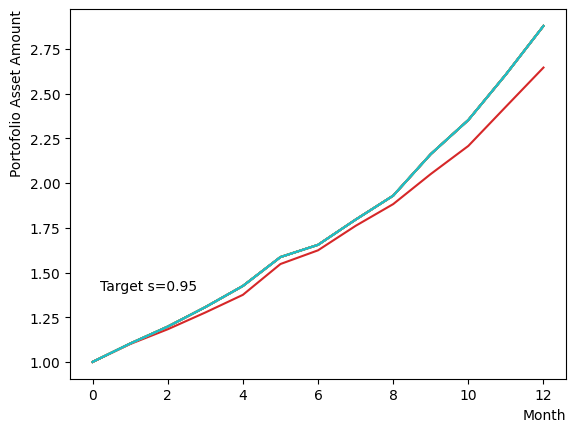

Next, we add a pause phase. After the addition of the pause phase, annealing is performed similarly, and the results are evaluated. As the addition of this phase is tantamount to extending the number of MC steps of the final stage of the reverse phase described above in terms of implementation, the results are as dispersed as those obtained in the reverse phase-only scenario depicted previously.

#Create Pause Step

NPauseStep = 50

TargetS = 0.15 # return to more random state

beta = 1.0 # allow for easier thermal hopping at higher temperatures

MC_step = 20

step_sche = [TargetS, beta, MC_step*NPauseStep]

RQAschedule.append(step_sche)

#print(RQAschedule)

ConvertScheduleToPlot(RQAschedule)

init_state = QA_init_state

sampleset_RQA_Reverse_Pause = sampler.sample_qubo(QUBO, schedule=RQAschedule, initial_state = init_state, num_reads=10, reinitialize_state=True) # execute annealing from the same initial state every time

for state in sampleset_RQA_Reverse_Pause.record:

selected_charts = list()

for i in range(Nassets):

if state[0][i]:

selected_charts.append(Chart[i])

portfolioChart = np.mean(selected_charts, axis=0)

plt.plot(list(range(13)), portfolioChart, label=("Energy="+str(state[1])))

plt.xlabel("Month", loc="right")

plt.ylabel("Portofolio Asset Amount", loc="top")

plt.legend()

plt.show()

print(sampleset_RQA_Reverse_Pause.record)

[([1, 0, 0, 1, 0, 1, 0, 0, 0, 0, 0, 0, 0, 0, 1, 0, 1, 1, 1, 0, 0, 1, 1, 1, 1, 1, 1, 0, 0, 1, 1, 0, 1, 1, 1, 0, 0, 0, 1, 1, 1, 1, 1, 1, 0, 1, 0, 1], -336., 1)

([1, 0, 0, 1, 0, 0, 0, 0, 1, 0, 0, 0, 0, 0, 1, 0, 1, 1, 0, 0, 0, 1, 1, 1, 1, 1, 1, 0, 0, 1, 1, 0, 1, 1, 1, 0, 0, 0, 0, 0, 1, 1, 0, 1, 0, 1, 1, 1], -342., 1)

([1, 0, 0, 0, 0, 0, 0, 0, 0, 0, 0, 0, 0, 0, 1, 1, 1, 1, 1, 1, 1, 1, 0, 1, 1, 1, 0, 0, 1, 1, 0, 0, 1, 1, 1, 1, 1, 0, 0, 1, 1, 1, 1, 1, 0, 1, 1, 1], -342., 1)

([1, 0, 0, 1, 0, 1, 0, 0, 0, 0, 0, 0, 1, 1, 0, 1, 1, 0, 0, 1, 0, 1, 1, 1, 0, 1, 1, 0, 1, 1, 0, 0, 1, 1, 1, 0, 1, 1, 0, 1, 1, 1, 1, 1, 0, 1, 0, 1], -326., 1)

([0, 0, 0, 1, 0, 1, 0, 1, 0, 0, 0, 0, 0, 1, 1, 1, 1, 1, 0, 0, 1, 1, 1, 1, 0, 1, 1, 0, 1, 1, 1, 0, 0, 1, 0, 0, 1, 0, 0, 0, 1, 1, 0, 1, 0, 1, 0, 1], -334., 1)

([0, 0, 0, 0, 0, 0, 0, 1, 0, 0, 0, 0, 1, 0, 1, 1, 1, 1, 1, 1, 1, 1, 1, 1, 0, 1, 1, 0, 1, 1, 0, 0, 0, 1, 0, 0, 1, 1, 0, 0, 1, 1, 1, 1, 0, 1, 1, 1], -316., 1)

([1, 0, 0, 0, 0, 0, 0, 0, 0, 0, 0, 0, 1, 1, 1, 1, 1, 1, 0, 1, 0, 1, 1, 1, 1, 1, 1, 0, 1, 1, 1, 1, 0, 1, 1, 0, 1, 0, 0, 0, 1, 1, 1, 0, 0, 1, 0, 1], -322., 1)

([1, 0, 0, 0, 0, 0, 0, 0, 0, 0, 0, 0, 1, 0, 1, 0, 1, 1, 0, 0, 1, 1, 1, 1, 1, 1, 0, 0, 0, 1, 0, 0, 0, 1, 1, 1, 0, 1, 0, 1, 1, 1, 0, 1, 0, 1, 0, 1], -322., 1)

([1, 0, 0, 1, 0, 1, 0, 1, 0, 0, 0, 0, 1, 0, 0, 1, 1, 1, 1, 1, 1, 1, 1, 1, 1, 1, 1, 0, 0, 1, 1, 0, 1, 1, 1, 1, 0, 0, 0, 1, 1, 1, 0, 1, 0, 1, 1, 1], -328., 1)

([1, 0, 0, 1, 0, 1, 0, 1, 0, 0, 0, 0, 0, 1, 1, 1, 1, 1, 0, 1, 1, 1, 0, 1, 0, 1, 1, 0, 1, 1, 1, 0, 0, 1, 1, 0, 1, 1, 0, 1, 1, 1, 0, 0, 0, 1, 1, 1], -312., 1)]

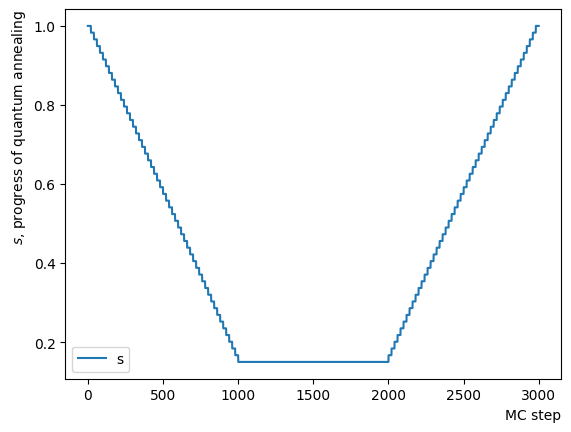

Finally, we incorporate a forward phase and execute annealing. This configuration is set up under conditions of slightly relaxed temperature and magnetic field relative to the previous sample. As a result, we can observe that the known optimal solution through quantum annealing is obtained for this particular set of stocks. Similar to the first example in the RQA section, we can observe that the optimal solution is obtained by RQA.

Since the conditions are slightly lenient, the solutions do not converge, and we can see the presence of multiple sub-optimal solutions with comparable energies. Among these solutions, we can also detect the presence of a portfolio whose final return outperforms the optimal solution obtained through forward annealing in certain cases and whose profile is relatively smooth. A closer examination of that portfolio details reveals that the substantial returns were achieved through a combination of specific stocks exhibiting substantial appreciation rates and stocks with relatively low volatility that possess inverse correlations. Although such a portfolio may be desirable in actual investment scenarios, the “Shape ratio is maximized” condition set up in this tutorial resulted in a relatively modest portfolio Sharpe ratio, which was deemed suboptimal through quantum annealing.

#Create Forward Step

NForwardStep = 50

TargetS = 0.15 # return to more random state

ForwardStep = (1.0 - TargetS) / NForwardStep

beta = 5.0 # allow for easier thermal hopping at higher temperatures

MC_step = 20

#Forward Step

for i in range(NForwardStep):

step_sche = [TargetS+(i+1)*ForwardStep, beta, MC_step]

RQAschedule.append(step_sche)

ConvertScheduleToPlot(RQAschedule)

init_state = QA_init_state

sampleset_RQA_Reverse_Pause_Forward = sampler.sample_qubo(QUBO, schedule=RQAschedule, initial_state = init_state, num_reads=10, reinitialize_state=True) # execute annealing from the same initial state every time

for state in sampleset_RQA_Reverse_Pause_Forward.record:

selected_charts = list()

for i in range(Nassets):

if state[0][i]:

selected_charts.append(Chart[i])

portfolioChart = np.mean(selected_charts, axis=0)

plt.plot(list(range(13)), portfolioChart, label=("Energy="+str(state[1])))

plt.xlabel("Month", loc="right")

plt.ylabel("Portofolio Asset Amount", loc="top")

plt.legend()

plt.show()

print(sampleset_RQA_Reverse_Pause_Forward.record)

[([1, 0, 0, 0, 0, 1, 0, 1, 0, 0, 0, 0, 0, 1, 1, 0, 1, 1, 0, 0, 1, 1, 1, 1, 1, 1, 1, 0, 0, 1, 1, 0, 1, 1, 1, 0, 1, 1, 0, 1, 1, 1, 1, 1, 0, 1, 1, 1], -397., 1)

([1, 0, 0, 0, 0, 1, 0, 1, 0, 0, 0, 0, 0, 1, 1, 0, 1, 1, 0, 0, 1, 1, 1, 1, 1, 1, 1, 0, 0, 1, 1, 0, 1, 1, 1, 0, 1, 1, 0, 1, 1, 1, 1, 1, 0, 1, 1, 1], -397., 1)

([1, 0, 0, 0, 0, 1, 0, 1, 0, 0, 0, 0, 0, 1, 1, 0, 1, 1, 0, 0, 1, 1, 1, 1, 1, 1, 1, 0, 0, 1, 1, 0, 1, 1, 1, 0, 1, 1, 0, 1, 1, 1, 1, 1, 0, 1, 1, 1], -397., 1)

([1, 0, 0, 0, 0, 1, 0, 1, 0, 0, 0, 0, 0, 1, 1, 0, 1, 1, 0, 0, 1, 1, 1, 1, 1, 1, 1, 0, 0, 1, 1, 0, 1, 1, 1, 0, 1, 1, 0, 1, 1, 1, 1, 1, 0, 1, 1, 1], -397., 1)

([1, 0, 0, 0, 0, 1, 0, 1, 0, 0, 0, 0, 0, 1, 1, 0, 1, 1, 0, 0, 1, 1, 1, 1, 1, 1, 1, 0, 0, 1, 1, 0, 1, 1, 1, 0, 1, 1, 0, 1, 1, 1, 1, 1, 0, 1, 1, 1], -397., 1)

([1, 0, 0, 0, 0, 1, 0, 1, 0, 0, 0, 0, 0, 1, 1, 0, 1, 1, 0, 0, 1, 1, 1, 1, 1, 1, 1, 0, 0, 1, 1, 0, 1, 1, 1, 0, 1, 1, 0, 1, 1, 1, 1, 1, 0, 1, 1, 1], -397., 1)

([1, 0, 0, 0, 0, 1, 0, 1, 0, 0, 0, 0, 0, 1, 1, 0, 1, 1, 0, 0, 1, 1, 1, 1, 1, 1, 1, 0, 0, 1, 1, 0, 1, 1, 1, 0, 1, 1, 0, 1, 1, 1, 1, 1, 0, 1, 1, 1], -397., 1)

([1, 0, 0, 0, 0, 1, 0, 1, 0, 0, 0, 0, 0, 1, 1, 0, 1, 1, 0, 0, 1, 1, 1, 1, 1, 1, 1, 0, 0, 1, 1, 0, 1, 1, 1, 0, 1, 1, 0, 1, 1, 1, 1, 1, 0, 1, 1, 1], -397., 1)

([1, 0, 0, 0, 0, 1, 0, 1, 0, 0, 0, 0, 0, 1, 1, 0, 1, 1, 0, 0, 1, 1, 1, 1, 1, 1, 1, 0, 0, 1, 1, 0, 1, 1, 1, 0, 1, 1, 0, 1, 1, 1, 1, 1, 0, 1, 1, 1], -397., 1)

([1, 0, 0, 0, 0, 1, 0, 1, 0, 0, 0, 0, 0, 1, 1, 0, 1, 1, 0, 0, 1, 1, 1, 1, 1, 1, 1, 0, 0, 1, 1, 0, 1, 1, 1, 0, 1, 1, 0, 1, 1, 1, 1, 1, 0, 1, 1, 1], -397., 1)]

Parameter search for specifying RQA schedule#

Examining the effects of the parameters in separate phases reveals that results vary based on the values of and , as well as the number of steps in the Quantum Monte Carlo method. From this perception, to achieve optimal performance with reverse annealing, it is necessary to determine appropriate values for these parameters.

In reverse phase#

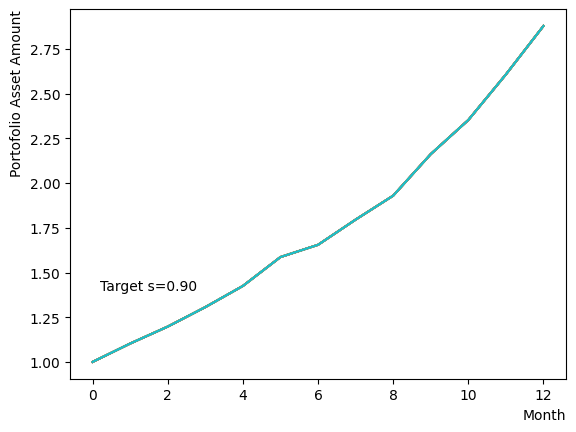

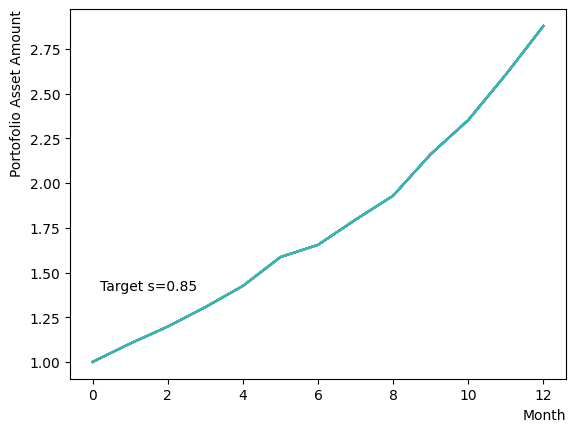

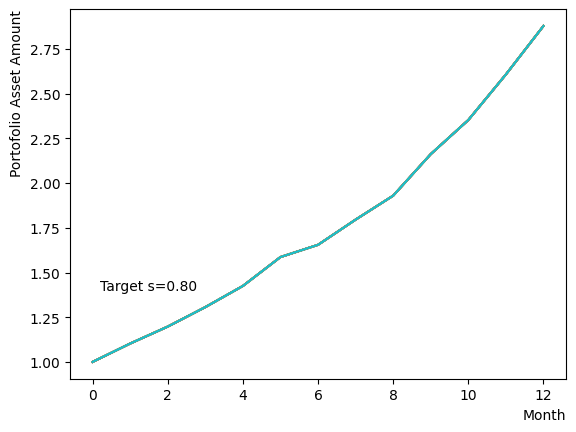

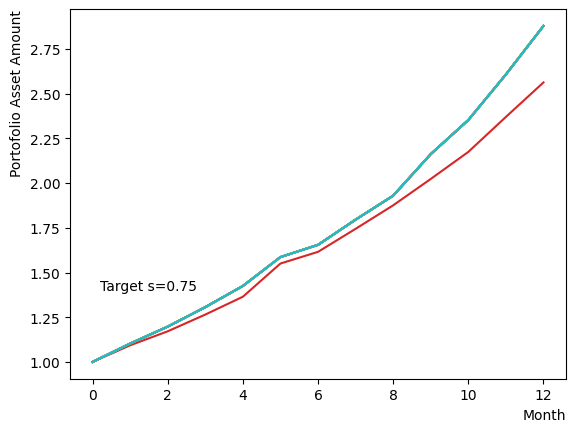

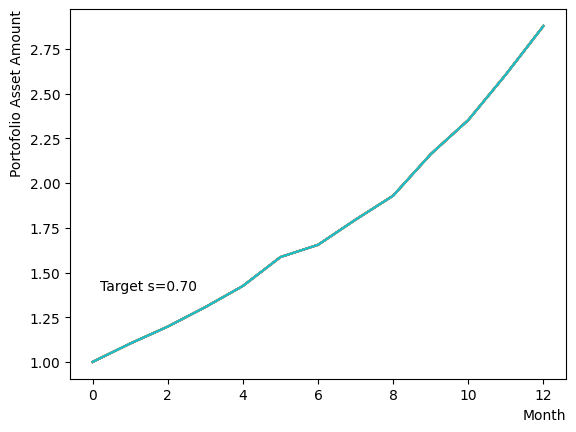

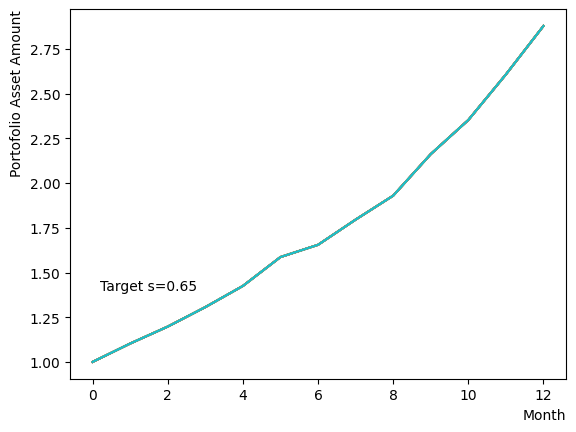

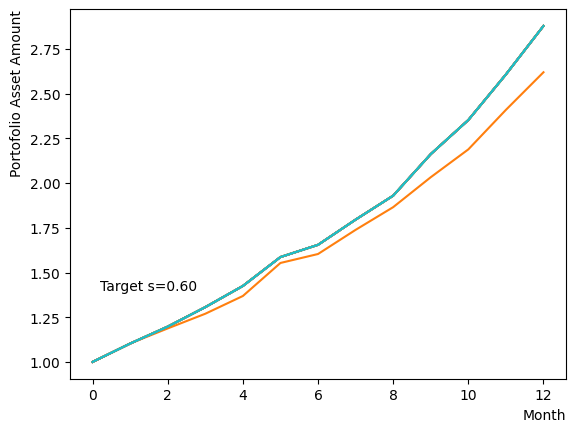

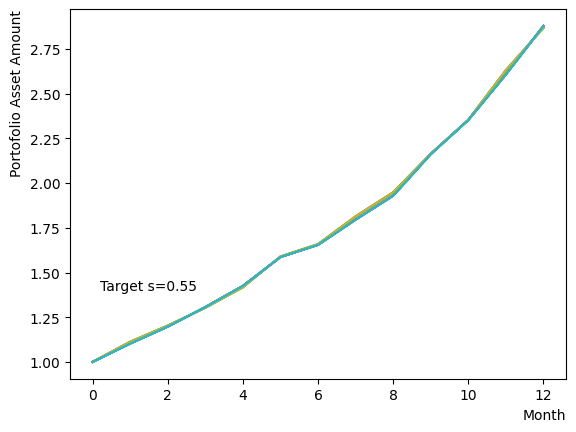

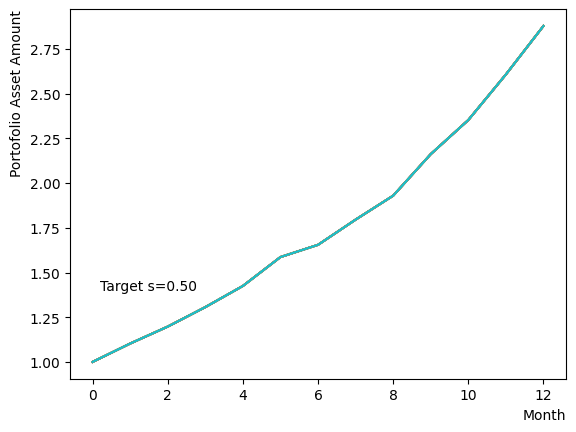

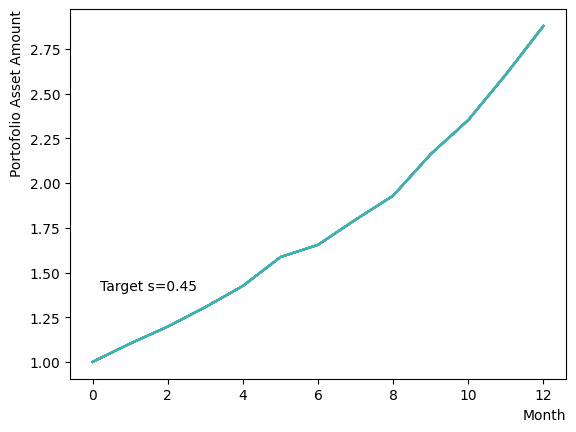

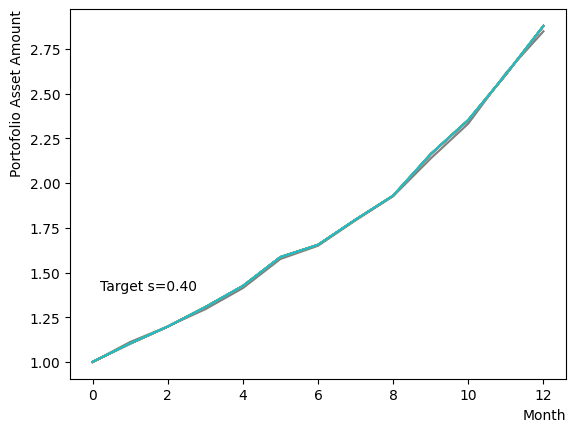

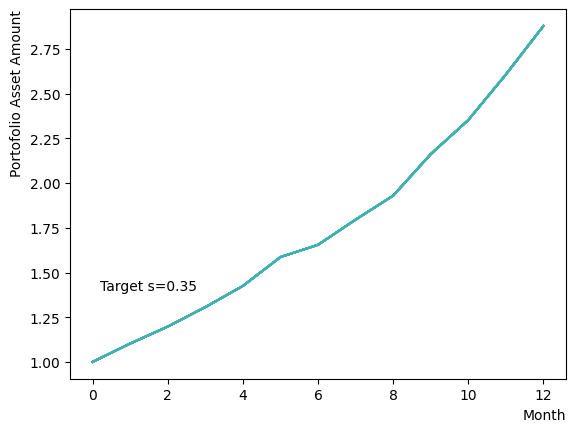

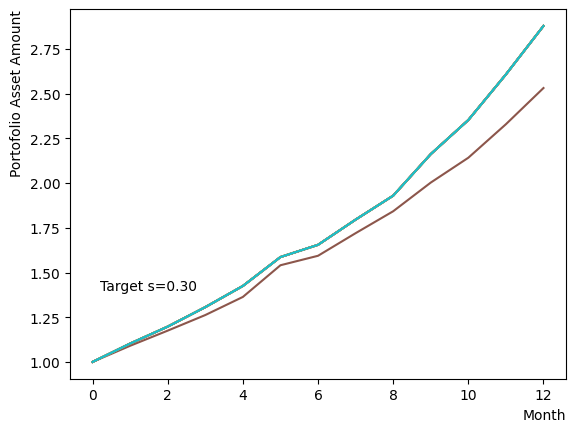

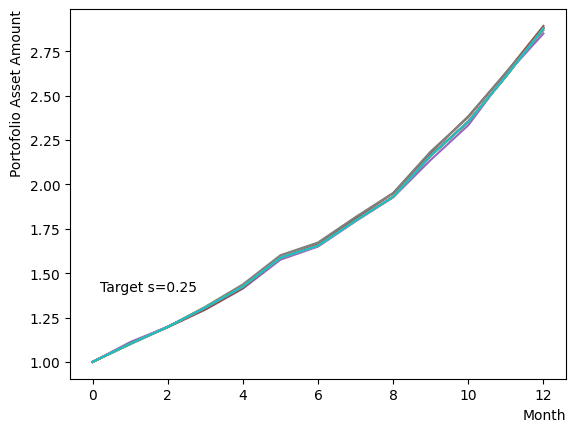

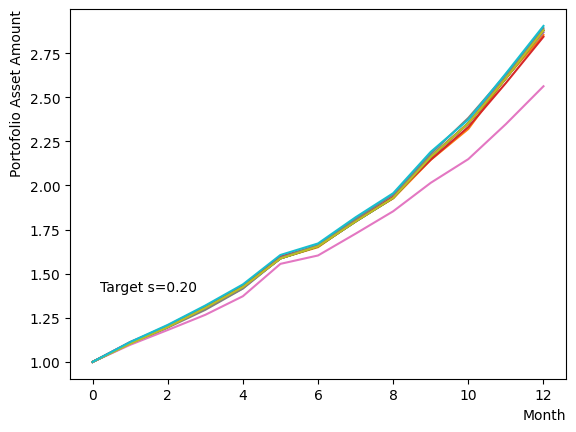

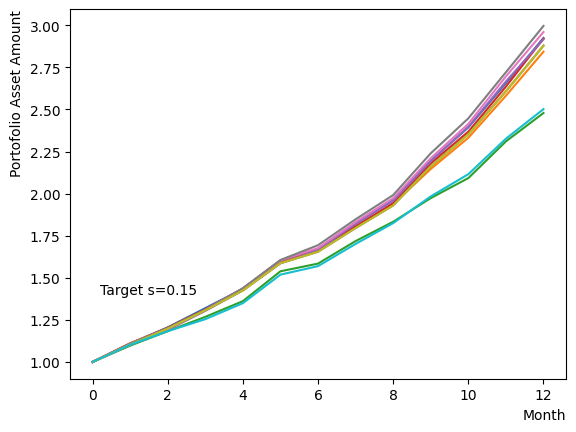

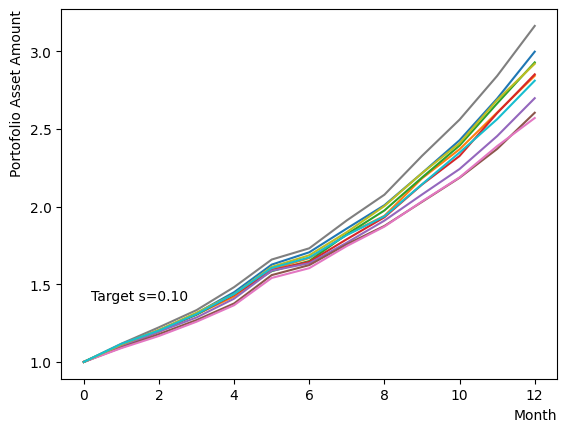

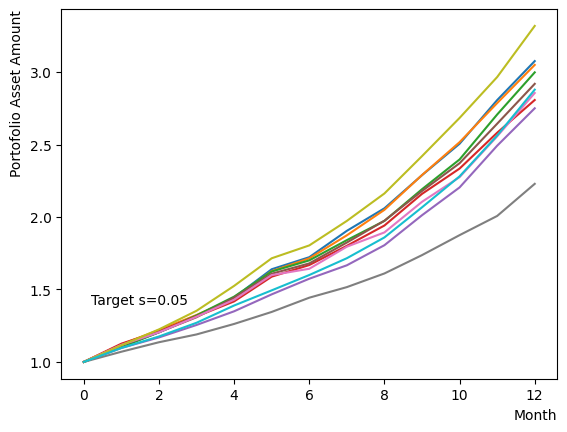

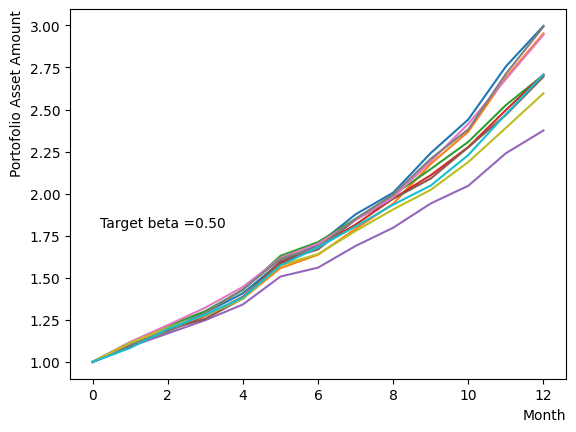

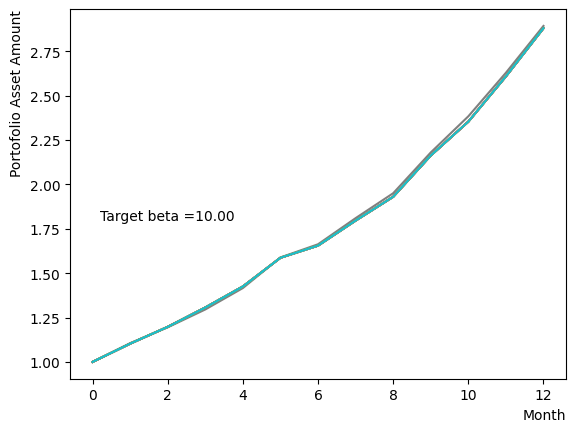

Initially, we consider their impact on the reverse phase. We start by analyzing the effect of , which represents the degree of quantum annealing. The transverse magnetic field intensity represented by must be set to an optimal value to allow for dispersion beyond the potential barrier around the local solution reached through initial annealing. Results show that for , thermal fluctuations become dominant and variations increase, so a finer scan around is expected to yield the optimal value.

for TargetS in reversed(np.arange(0.05, 1.0, 0.05)):

#Create RQA schedule

RQAschedule = []

NReverseStep = 50

ReverseStep = (1.0 - TargetS) / NReverseStep

beta = 5.0

MC_step = 20

#Reverse Step

#for i in range(NReverseStep):

for i in range(NReverseStep):

step_sche = [1.0-i*ReverseStep, beta, MC_step]

RQAschedule.append(step_sche)

init_state = QA_init_state

sampleset_RQA_Reverse = sampler.sample_qubo(QUBO, schedule=RQAschedule, initial_state = init_state, num_reads=10, reinitialize_state=True) # execute annealing from the same initial state every time

for state in sampleset_RQA_Reverse.record:

selected_charts = list()

for i in range(Nassets):

if state[0][i]:

selected_charts.append(Chart[i])

portfolioChart = np.mean(selected_charts, axis=0)

plt.plot(list(range(13)), portfolioChart, label=("Energy="+str(state[1])))

plt.xlabel("Month", loc="right")

plt.ylabel("Portofolio Asset Amount", loc="top")

plt.text(0.2,1.4, "Target s="+'{:.2f}'.format(TargetS))

plt.show()

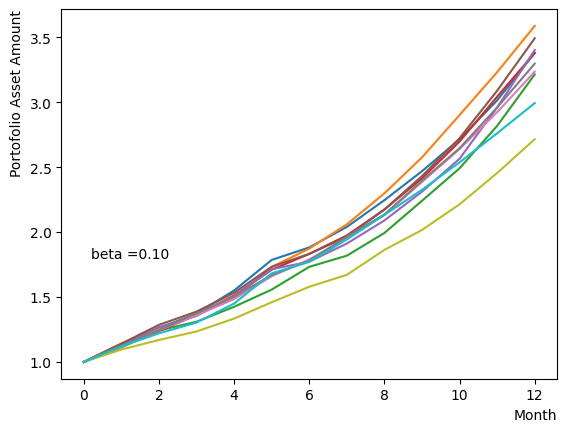

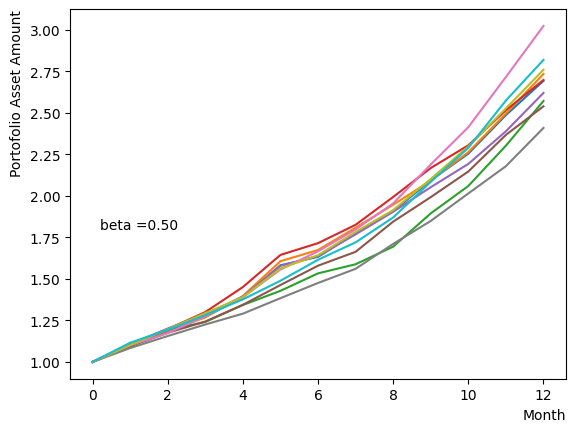

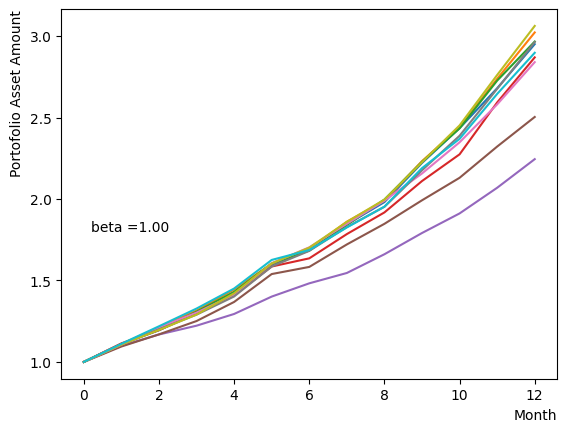

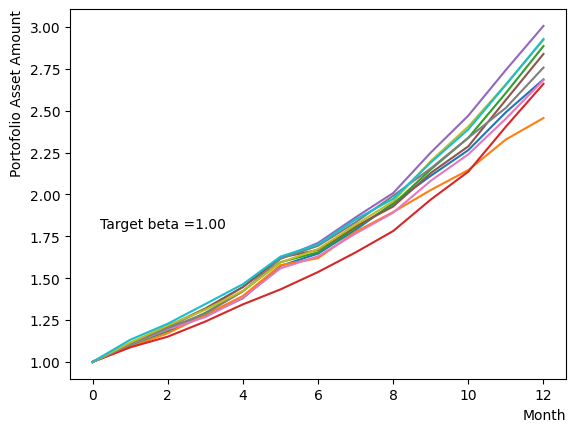

Next, we consider the effect of . represents the inverse temperature, where a larger means that the system is cooler. In other words, the larger is, the more easily the overall state reaches to the ground state and behaves more likely an “annealed” state. For a constant transverse magnetic field, as increases, the effectiveness of the transverse magnetic field decreases and begins to resemble that of a large . For more details on this effect in OpenJij, please refer to this Qiita article.

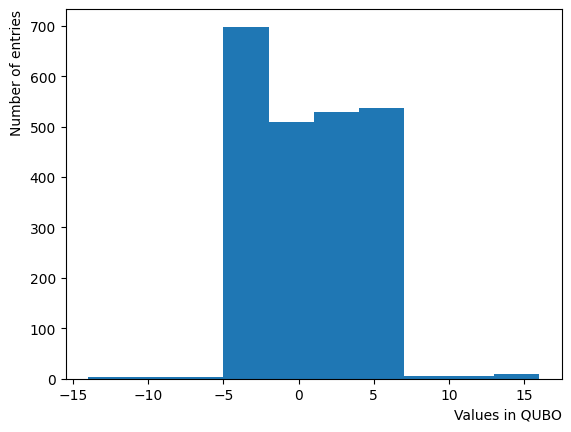

It is acknowledged that the effect change by the typical scale of energy present within the QUBO matrix. In this tutorial, the typical value of the QUBO matrix roughly equates to , thus we expect the variation to occur around .

plt.hist((QUBO).flatten())

plt.xlabel("Values in QUBO", loc="right")

plt.ylabel("Number of entries", loc="top")

Text(0, 1, 'Number of entries')

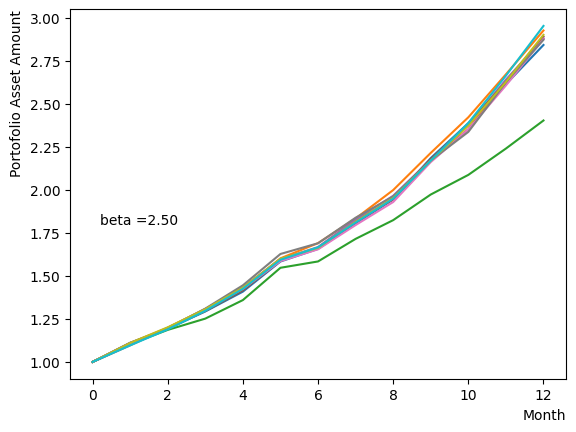

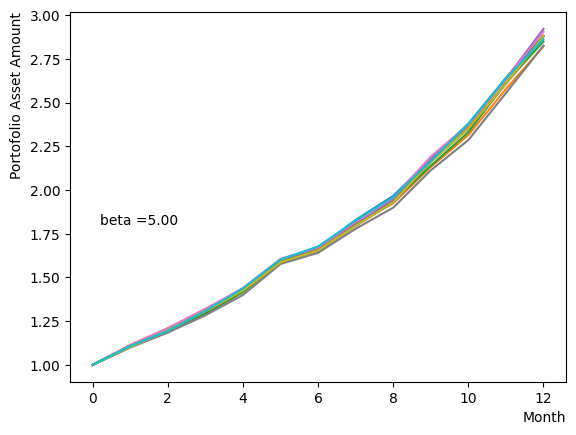

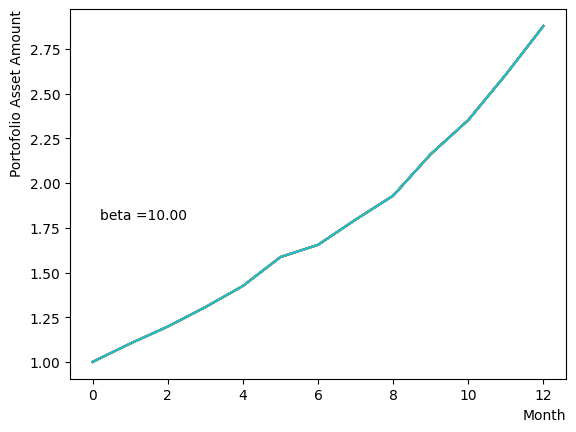

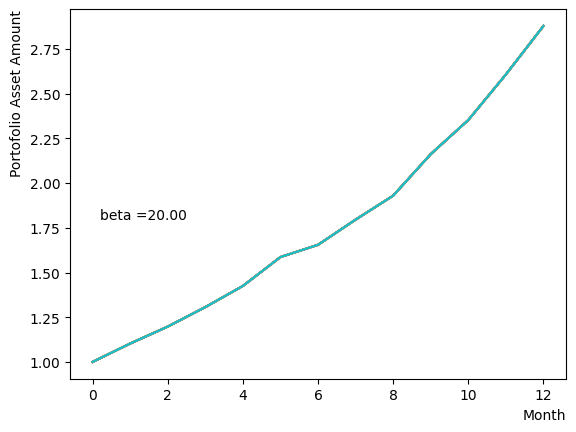

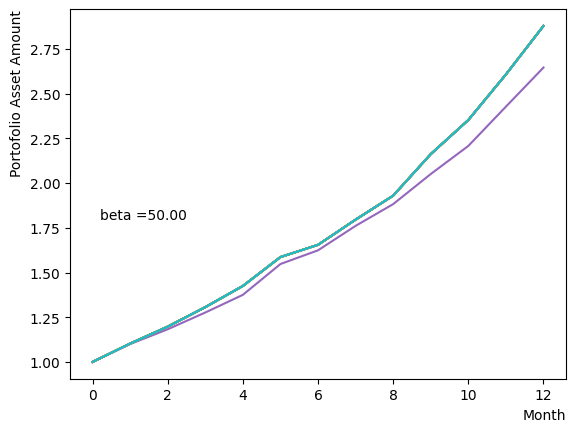

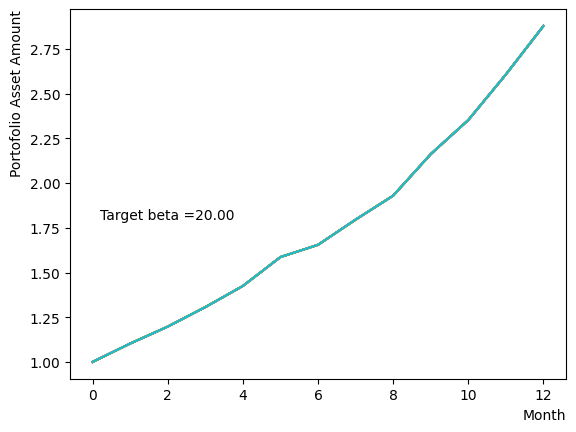

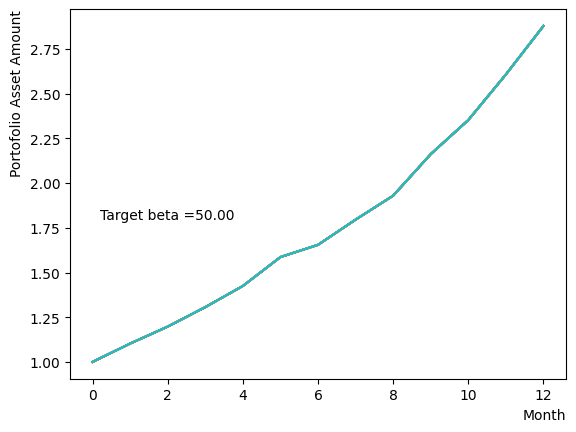

We generate a logarithmic array of and implement a Reverse Phase with all parameters fixed, excluding . As expected, the dispersion of the final state becomes minimal around , and for higher values of , we observe that the states converge to a few states.

for beta in [0.1,0.5,1.0,2.5,5.0,10.0,20.0,50.0]:

#Create RQA schedule

RQAschedule = []

NReverseStep = 50

TargetS = 0.18

ReverseStep = (1.0 - TargetS) / NReverseStep

MC_step = 20

#Reverse Step

#for i in range(NReverseStep):

for i in range(NReverseStep):

step_sche = [1.0-i*ReverseStep, beta, MC_step]

RQAschedule.append(step_sche)

init_state = QA_init_state

sampleset_RQA_Reverse = sampler.sample_qubo(QUBO, schedule=RQAschedule, initial_state = init_state, num_reads=10, reinitialize_state=True) # execute annealing from the same initial state every time

for state in sampleset_RQA_Reverse.record:

selected_charts = list()

for i in range(Nassets):

if state[0][i]:

selected_charts.append(Chart[i])

portfolioChart = np.mean(selected_charts, axis=0)

plt.plot(list(range(13)), portfolioChart, label=("Energy="+str(state[1])))

plt.xlabel("Month", loc="right")

plt.ylabel("Portofolio Asset Amount", loc="top")

plt.text(0.2,1.8, "beta ="+'{:.2f}'.format(beta))

plt.show()

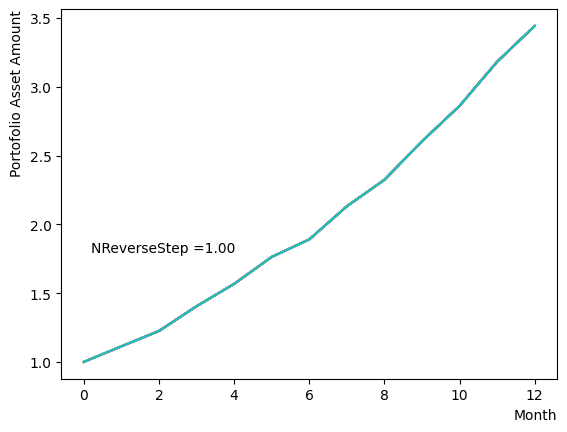

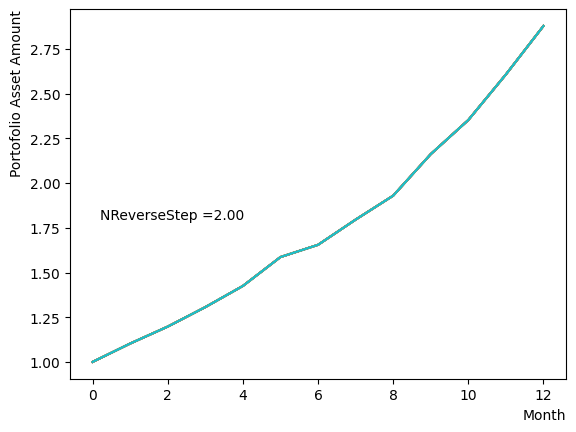

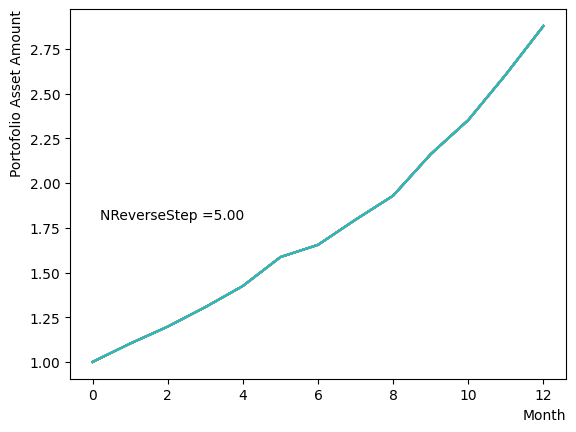

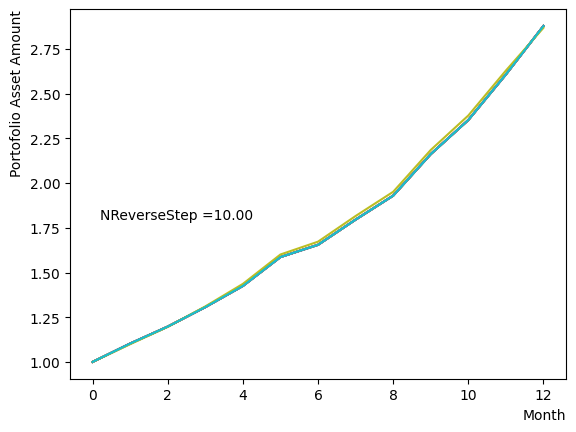

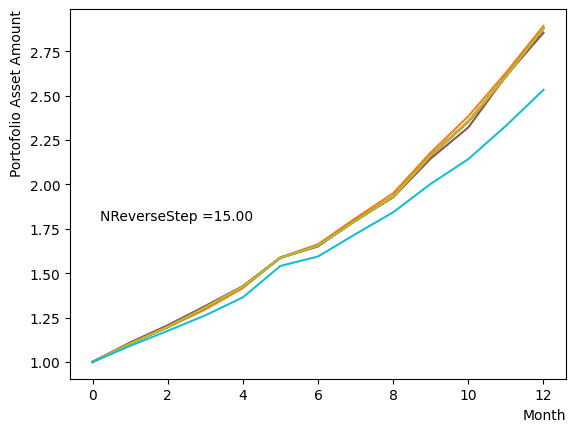

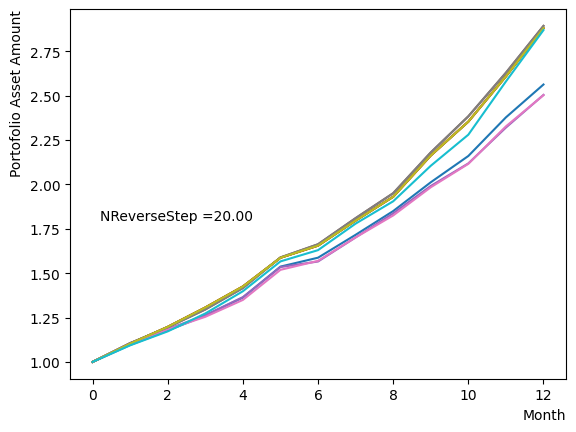

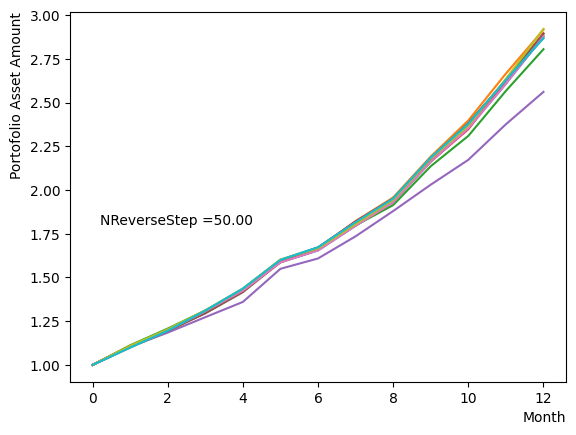

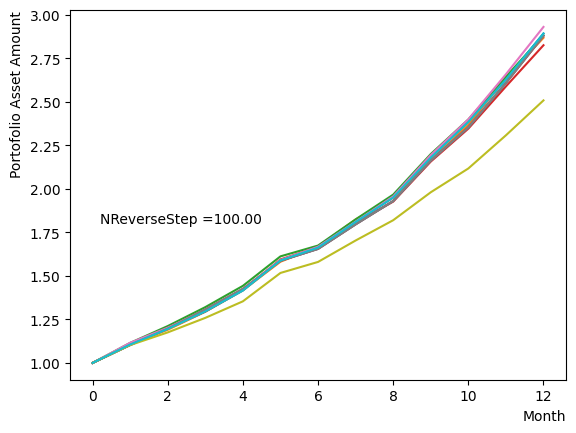

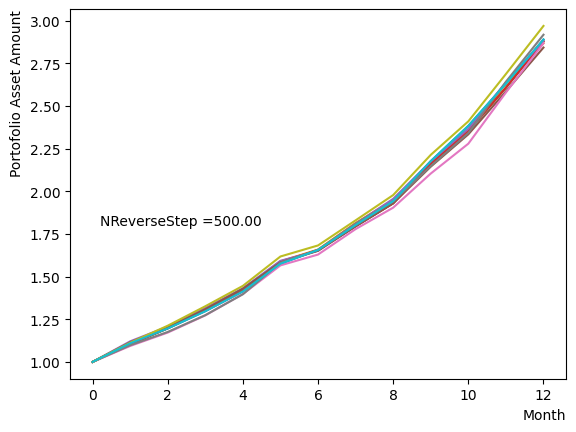

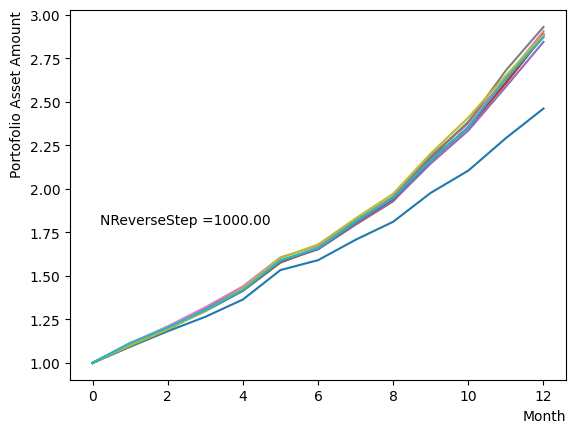

Next, we analyze the impact of schedule partitioning. Here we examine extreme cases, such as the step function, as well as the scenario of a gradual alteration achieved by dividing the schedule into smaller segments. As the results indicate, the state does not significantly change when the number of divisions is limited, whereas an increase in the number of divisions leads to noticeable variation. Additionally, a substantial increase in the number of divisions only increases the computational time and trivial differences in the outcomes. For the portfolio optimization problem addressed in this tutorial, approximately is found to not pose a problem.

for NReverseStep in [1,2,5,10,15,20,50,100,500,1000]:

#Create RQA schedule

RQAschedule = []

TargetS = 0.18

ReverseStep = (1.0 - TargetS) / NReverseStep

beta = 5.0

MC_step = 20

#Reverse Step

#for i in range(NReverseStep):

for i in range(NReverseStep):

step_sche = [1.0-i*ReverseStep, beta, MC_step]

RQAschedule.append(step_sche)

init_state = QA_init_state

sampleset_RQA_Reverse = sampler.sample_qubo(QUBO, schedule=RQAschedule, initial_state = init_state, num_reads=10, reinitialize_state=True) # execute annealing from the same initial state every time

for state in sampleset_RQA_Reverse.record:

selected_charts = list()

for i in range(Nassets):

if state[0][i]:

selected_charts.append(Chart[i])

portfolioChart = np.mean(selected_charts, axis=0)

plt.plot(list(range(13)), portfolioChart, label=("Energy="+str(state[1])))

plt.xlabel("Month", loc="right")

plt.ylabel("Portofolio Asset Amount", loc="top")

plt.text(0.2,1.8, "NReverseStep ="+'{:.2f}'.format(NReverseStep))

plt.show()

Also, with regards to MC steps, it is determined that its impact on the final result is negligible unless the product of (number of divisions)x(MC steps) is excessively small.

In the case of the default setting with SQASampler(), about should work.

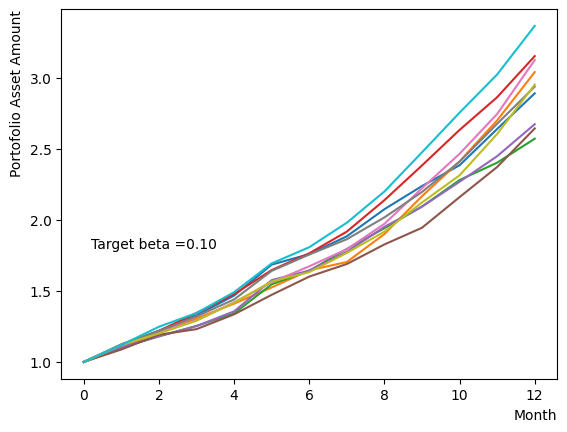

For pause phase#

As already explained, the pause phase is an extension of the final step of the reverse phase, behaves similarly to the reverse phase when altering and of the overall annealing. Also, since the steps of the pause phase is equivalent to the extension of the final step, its impact on the reverse phase is expected to be limited, even if it is changed.

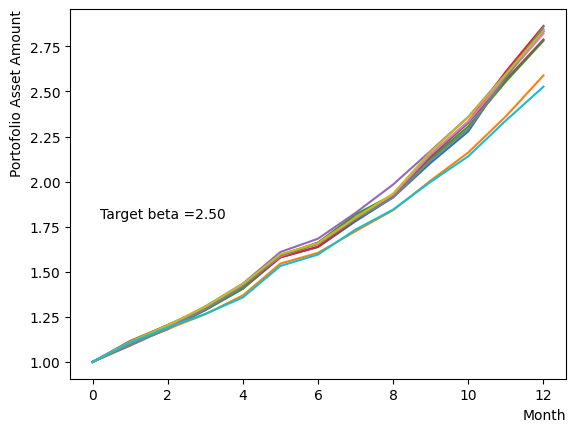

However, modifying only during the pause phase resembles classical annealing with incomplete quantum annealing. Here we examine the effect of changing the system temperature from to a gradual target . We obtain the results that are similar to the final state when annealing is performed at a different in reverse phase.

for beta in [0.1,0.5,1.0,2.5,5.0,10.0,20.0,50.0]:

#Create RQA schedule

RQAschedule = []

NReverseStep = 50

TargetS = 0.18

ReverseStep = (1.0 - TargetS) / NReverseStep

MC_step = 20

#Reverse Step

#for i in range(NReverseStep):

for i in range(NReverseStep):

step_sche = [1.0-i*ReverseStep, 5.0, MC_step]

RQAschedule.append(step_sche)

#Pause Phase

NPauseStep = 50

betaStep = (5.0-beta) / NPauseStep

for i in range(NReverseStep):

step_sche = [TargetS, 5.0-i*betaStep, MC_step]

RQAschedule.append(step_sche)

init_state = QA_init_state

sampleset_RQA_Reverse_Pause = sampler.sample_qubo(QUBO, schedule=RQAschedule, initial_state = init_state, num_reads=10, reinitialize_state=True) # execute annealing from the same initial state every time

for state in sampleset_RQA_Reverse_Pause.record:

selected_charts = list()

for i in range(Nassets):

if state[0][i]:

selected_charts.append(Chart[i])

portfolioChart = np.mean(selected_charts, axis=0)

plt.plot(list(range(13)), portfolioChart, label=("Energy="+str(state[1])))

plt.xlabel("Month", loc="right")

plt.ylabel("Portofolio Asset Amount", loc="top")

plt.text(0.2,1.8, "Target beta ="+'{:.2f}'.format(beta))

plt.show()

For forward phase#

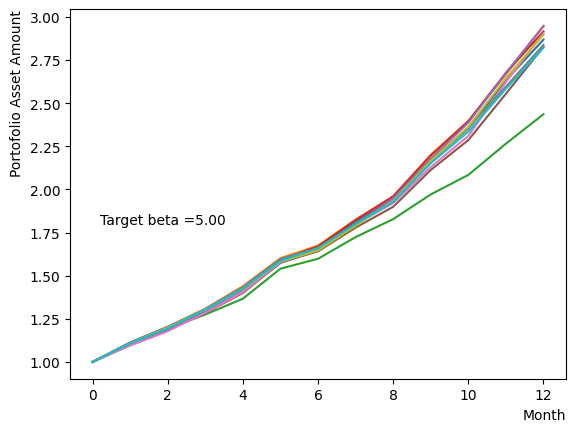

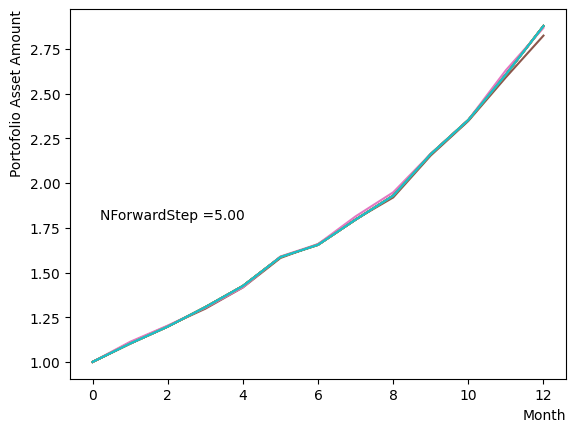

The forward phase is the stage in which standard quantum annealing is executed, starting from the states acquired through the reverse and pause Phases. The conditions for the parameters in this phase we have to consider are essentially equivalent to those required for standard annealing to work correctly. We examine and the number of division steps in the same way as reverse and pause phases , we find that even with a modest number of divisions and , the results converged to the optimal solution.

An example script is shown below. In the reverse phase and pause phase, we employ the settings obtained from previous investigations, with only the forward phase undergoing annealing with a coarse resolution and small .

#Create RQA schedule

RQAschedule = []

NReverseStep = 50

TargetS = 0.18

ReverseStep = (1.0 - TargetS) / NReverseStep

MC_step = 20

#Reverse Step

#for i in range(NReverseStep):

for i in range(NReverseStep):

step_sche = [1.0-i*ReverseStep, 5.0, MC_step]

RQAschedule.append(step_sche)

#Pause Phase

NPauseStep = 50

step_sche = [TargetS, 5.0, MC_step*NPauseStep]

RQAschedule.append(step_sche)

#Forward Phase

NForwardStep = 5

ForwardStep = (1.0 - TargetS) / NForwardStep

for i in range(NForwardStep):

step_sche = [TargetS+(i+1)*ForwardStep, 2.5, MC_step]

RQAschedule.append(step_sche)

init_state = QA_init_state

sampleset_RQA_Reverse_Pause_Forward = sampler.sample_qubo(QUBO, schedule=RQAschedule, initial_state = init_state, num_reads=10, reinitialize_state=True) # execute annealing from the same initial state every time

for state in sampleset_RQA_Reverse_Pause_Forward.record:

selected_charts = list()

for i in range(Nassets):

if state[0][i]:

selected_charts.append(Chart[i])

portfolioChart = np.mean(selected_charts, axis=0)

plt.plot(list(range(13)), portfolioChart, label=("Energy="+str(state[1])))

plt.xlabel("Month", loc="right")

plt.ylabel("Portofolio Asset Amount", loc="top")

plt.text(0.2,1.8, "NForwardStep ="+'{:.2f}'.format(NForwardStep))

plt.show()

Concluding remarks#

We implemented reverse quantum annealing utilizing OpenJij to solve a portfolio optimization problem. In this tutorial, we elucidated the RQA problem formulation, the procedure for specifying the schedule, and the parameters to take into account when performing RQA. We showed that the RQA method can be used to obtain the correct optimal solution.

Similar methods can be employed to discover a better solution for other difficult problem with numerous suboptimal solutions close to the optimal one. If we only obtain a predicament with local minimum through standard quantum annealing, attempting RQA in this manner may assist in resolving the predicament.

Additionally, there were some aspects of RQA that we did not discuss in this tutorial, such as the effect of the schedule from a linear function to a nonlinear form, yet we can be easily implemented it by modifying the code in this treatise. If you are interested, please give it a try.

Appendix A: if the simulation results are not good…#

The script in this tutorial to generate a stock set is not guaranteed to yield an “admirable” set of stocks. Therefore, there exists the possibility of experimenting with sets that possess a biased distribution in certain instances. In such situations, the genetic algorithm calculation might experience an extended execution time or RQA might not converge with parameters such as or that were utilized by default in this tutorial. In such cases, we might consider regenerating the stock set or manually adjusting the RQA parameters to reach the optimal resolution.

Appendix B: Executing RQA on the D-Wave machine#

RQA can also be performed on D-Wave machines by using the method described in this tutorial. We show a sample script below. The schedule settings and other arguments differ based on the implementation and the discrepancy between the simulation and the actual machine, however, the implementation is fundamentally the same. For more details, please refer to the documentation on the official D-Wave website. Moreover, the difference in outcomes between standard annealing and RQA is more likely to become apparent on an actual device, given that the effects of noise and the like are more likely to be observed.

from dwave.system import DWaveSampler, EmbeddingComposite

token = '*** your user token ***'

endpoint = '*** your dwave endpoint***' #'https://cloud.dwavesys.com/sapi/' as defaults

dw_sampler = DWaveSampler(solver='Advantage_system4.1', token=token) #Choose your dwave machine/simulator

sampler = EmbeddingComposite(dw_sampler)

Nassets = 48

# RQA schedule

timing = (0,1,2,3) # start and end time of each phase

Ratio = (1.0,0.38,0.38,1.0) # value of s when each phase changes

schedule = list(zip(timing,Ratio)) # put them together in a schedule

plt.plot(timing,Ratio)

plt.show()

#Create QUBO

QUBO = np.random.rand(Nassets**2).reshape(Nassets, Nassets)

for i in range(Nassets):

for j in range(Nassets):

QUBO[i][j] = PairwiseCorrMat[i][j]

for i in range(Nassets):

QUBO[i][i] = QUBO[i][i] + SR_list[i]

import matplotlib.pyplot as plt

plt.imshow(QUBO)

plt.colorbar()

plt.show()

#FQA

sampleset = sampler.sample_qubo(QUBO,num_reads=10)

print(sampleset.record)

min_forword = 0

for result in sampleset.record:

if result[1] < min_forword:

min_forword = result[1]

best_forword = result[0]

selected_charts = list()

for i in range(Nassets):

if best_forword[i]:

selected_charts.append(Chart[i])

portfolioChart_FQA = np.mean(selected_charts, axis=0)

plt.plot(list(range(13)), portfolioChart_FQA,color="r",label="Forward Annealing")

#RQA

sampleset_RQA = sampler.sample_qubo(QUBO,num_reads=10, anneal_schedule=schedule, initial_state = QA_init_state)

print(sampleset_RQA.record)

min_RQA = 0

for result in sampleset_RQA.record:

if result[1] < min_RQA:

min_RQA = result[1]

best_RQA = result[0]

selected_charts = list()

for i in range(Nassets):

if best_RQA[i]:

selected_charts.append(Chart[i])

portfolioChart_RQA = np.mean(selected_charts, axis=0)

plt.plot(list(range(13)), portfolioChart_RQA,color="b",label="Reverse Annealing")

plt.xlabel("Month", loc="right")

plt.ylabel("Portofolio Asset Amount", loc="top")

plt.legend()

plt.show()

References#

Harry Markowitz, “Portfolio selection”, The journal of finance, 7(1):77–91 (1952)

Sharpe, William F., “Mutual fund performance”, The Journal of Business 39 (1), 119-138 (1966)